Asia Automotive Camshaft Industry Overview

The Asia automotive camshaft market size was valued at USD 1.86 billion in 2020 and is expected to expand a compound annual growth rate (CAGR) of 3.0% from 2021 to 2028. Increasing sales of passenger cars and commercial vehicles, coupled with the increasing adoption of double overhead camshaft engines in passenger cars, are expected to drive the market growth over the forecast period. Moreover, stringent government regulations associated with carbon emission have forced automotive OEMs to adopt lightweight engines, which is anticipated to boost the product demand in the near future. Automotive engine manufacturers are increasing the number of valves in the engine to enhance the volumetric efficiency and power output of engines, which can be achieved using a double overhead camshaft.

A double overhead camshaft incorporates four valves for each cylinder, two exhausts, and two intakes. The use of four valves per cylinder allows for a more effortless flow of gases and fuel, both in and out of the cylinder, thus increasing the performance of the vehicle, particularly, at high speeds. Thus, the rising adoption of double overhead camshaft engines is likely to fuel the market growth over the forecast period.

Gather more insights about the market drivers, restraints and growth of the Asia Automotive Camshaft market

A promising rise in the sales of commercial and passenger vehicles across several countries in the region is also expected to drive the market. According to the International Organization of Motor Vehicle Manufacturers (OICA), over 91 million new passenger and commercial vehicles were registered or sold globally in 2019. Of this, over 44 million motor vehicles, or nearly 48% of the global total, were sold in Asia. This has led to a significant rise in product demand in the region.

The Covid-19 pandemic has negatively impacted the overall product demand in 2020. Globally, several countries announced lockdowns and social distancing norms subsequently leading to losses for industries, such as manufacturing, automobile, entertainment, restaurant, and hospitality. This resulted in a decline in the overall automotive production volumes, globally, on a year-on-year basis. However, as governments begin to gradually relax the lockdown norms and allow businesses to operate with mandates of social distancing, the market can expect a period of respite for the short-term due to the growing demand for passenger cars.

Browse through Grand View Research's Technology Industry Related Reports

Commercial Vehicles Market - The global commercial vehicles market size was estimated at USD 1,274.50 billion in 2021 and is projected to register a compound annual growth rate (CAGR) of 4.0% from 2022 to 2030.

Electric Vehicle Market - The global electric vehicle market demand was estimated at 2,373.5 thousand units in 2019 and is expected to witness a CAGR of 41.5% 2020 to 2027.

Asia Automotive Camshaft Industry Segmentation

Grand View Research has segmented the Asia automotive camshaft market on the basis of engine type, fuel type, manufacturing technology, vehicle type, sales channel, and region:

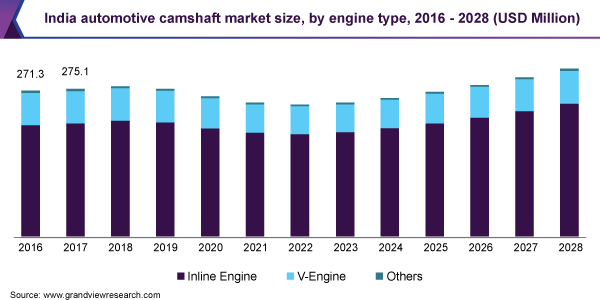

Asia Automotive Camshaft Engine Type Outlook (Revenue, USD Million, 2016 - 2028)

- Inline Engine

- V-Engine

- Others

Asia Automotive Camshaft Fuel Type Outlook (Revenue, USD Million, 2016 - 2028)

- Diesel

- Gasoline

Asia Automotive Camshaft Manufacturing Technology Outlook (Revenue, USD Million, 2016 - 2028)

- Assembled Camshaft

- Cast Camshaft

- Forged Camshaft

Asia Automotive Camshaft Vehicle Type Outlook (Revenue, USD Million, 2016 - 2028)

- Passenger Cars

- Commercial Vehicles

Asia Automotive Camshaft Sales Channel Outlook (Revenue, USD Million, 2016 - 2028)

- OEMs

- Aftermarket

Asia Automotive Camshaft Regional Outlook (Revenue, USD Million, 2016 - 2028)

- South Asia

- Southeast Asia

- East Asia

- Central Asia

- West Asia

Market Share Insights:

October 2019: PCL India acquired 76% shares of Fahrzeugtechnik GmbH and MFT Motoren and 51% of stake in EMOSS Mobile Systems BV through its PCL (International) Holding BV, a wholly-owned subsidiary in the Netherlands. This acquisition was aimed at enabling PCL India to establish a global brand presence.

June 2019: ThyssenKrupp AG announced its investment of approximately USD 17.4 billion to construct a camshaft plant in Pécs, Hungary.

Key Companies profiled:

Some prominent players in the Asia Automotive Camshaft Industry include

- Engine Power Components, Inc.

- Guangzhou Disong Machinery Equipment Co., Ltd.

- Guizhou MEC, Inc.

- India Pistons Ltd. (IPL)

- MAHLE GmbH

- Musashi Seimitsu Industry Co., Ltd.

- PCL India

- Thyssenkrupp AG

- Ruich Value (Shenyang) Tech. Co., Ltd

- Shijiazhuang Jingshi New Material Science and Technology Co., Ltd.

Order a free sample PDF of the Asia Automotive Camshaft Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment