U.S. Processed Pumpkin Industry Overview

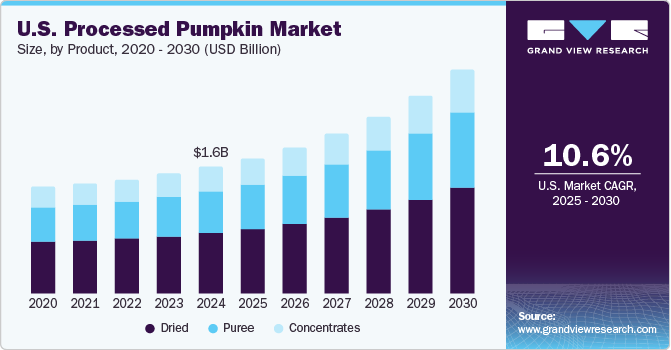

The U.S. processed pumpkin market size was valued at USD 1.34 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.5% from 2021 to 2028. Shifting consumer preference toward packaged convenience foods is expected to drive the demand for processed pumpkin over the next few years. Processed pumpkin has been witnessing a remarkable demand from the food and beverage industry, not only due to its taste and flavor but also because of the numerous health benefits associated with it. The COVID-19 pandemic has had a direct and indirect impact on the demand for processed pumpkins in the U.S. The coronavirus outbreak has affected the raw material as well as application industries. In addition to this, companies have also witnessed transportation delays. The pandemic has had an adverse impact on the supply chain of the fruit and vegetable industry in the U.S., with lower prices and reduced production emerging as the key problems within the industry.

Processed pumpkin is one of the most versatile cooking ingredients and its rich and creamy texture is ideal for preparing both sweet and savory dishes, including desserts and ice creams. It is also very commonly used for preparing sauces, spreads, creams, soups, and dressings that require added thickness with lower fat content. These numerous applications are propelling the demand for the product in the U.S.

Gather more insights about the market drivers, restraints and growth of the U.S. Processed Pumpkin market

Processed pumpkin is widely used not just for home cooking but also in various commercial applications in restaurants, bakeries, eateries, and the hotel industry. Furthermore, the increasing application of the product in the form of powder, puree, and chunks in several food processing sectors, including bakery, beverages, smoothies, confectionary, baby foods, dairy, and frozen products, is expected to boost the market growth.

One of the key factors driving the demand for the product is the increasing consumer awareness about the nutritive value of pumpkin in the U.S. A shift has been observed toward healthier diets, which is resulting in changing food choices. Consumers are increasingly opting for healthy food choices that will help maintain their body weight, meet their nutritional requirements, and prevent chronic diseases.

The growing trend of organic food and beverages in the U.S. is expected to widen the opportunities for organic processed pumpkin in the upcoming years. This is attributed to the increasing awareness about the harmful effects of pesticides, chemicals, and additives on human health and the high per-capita income of U.S. consumers. Furthermore, the growing number of health-conscious consumers and the rising awareness regarding the health benefits associated with organic pumpkins and clean label products are likely to drive the demand for organic processed pumpkins.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Processed & Frozen Vegetables Market - The global processed & frozen vegetables market size was valued at USD 77.97 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.9% from 2022 to 2028.

U.S. Vegetable Puree Market - The U.S. vegetable puree market size was valued at USD 6.22 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2021 to 2028.

U.S. Processed Pumpkin Industry Segmentation

Grand View Research has segmented the U.S. processed pumpkin market on the basis of product and application:

U.S. Processed Pumpkin Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

- Dried

- Puree

- Concentrates

U.S. Processed Pumpkin Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

- Beverages

- Bakery

- Snacks

- Desserts

- Baby Food

- Others

Market Share Insights:

April 2019, Döhler Group acquired Zumos Catalano Aragoneses S.A. (ZUCASA), a Spain-based manufacturer of purees, sweet fruit concentrates, juices, vegetables, and plants. This acquisition enabled Döhler to offer more diverse products in the stone fruits and apples and pears segments.

Key Companies profiled:

Some prominent players in the U.S. Processed Pumpkin Industry include

- Döhler Group

- Ingredion Incorporated (Kerr Concentrates)

- Woodland Foods

- Seawind Foods

- Cedenco Foods

- Nubeleaf

- Libby's

- Milne MicroDried

- Great American Spice Company

Order a free sample PDF of the U.S. Processed Pumpkin Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment