Therapeutic Bed Industry Overview

The global therapeutic bed market size was valued at USD 4.22 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.01% from 2022 to 2030. Key drivers expected to contribute to market growth include the rising geriatric population, an increase in disease burden, high unmet medical needs in emerging & low-growth economies, and a rise in public & private healthcare expenditure to improve the number of beds to patients ratio. Moreover, the rising demand for bariatric surgeries, ambulatory surgeries, inpatient surgeries, and critical care services for preoperative and postoperative procedures is also expected to boost the market over the forecast period.

The global need for therapeutic beds has risen significantly as a result of the COVID-19 outbreak and increased hospital admissions. Beginning in March 2020, the surge in COVID-19 patients significantly impacted hospitals. In addition, the change from standard beds to specialty COVID-19 beds with additional hygiene measures, as well as pressure on the number of beds, which originated primarily from the need to anticipate sufficient capacity in the ICU, have all contributed to market growth. As a result, the sales of therapeutic beds significantly increased during the pandemic. According to the FDA, in October 2020, there was a high demand for mattresses, hospital beds, and stretchers to enhance capacity in healthcare systems & local hospitals via temporary expansion sites.

Gather more insights about the market drivers, restraints, and growth of the Global Therapeutic Bed market

To address the same, manufacturers from several industries, who are not traditionally associated with medical devices manufacturing used resources to market and produce these devices for the healthcare community, which, in turn, augmented the market growth. The prevalence of chronic diseases, such as urological disorders, cancer, Cardiovascular Disorders (CVDs), neurovascular diseases, and other chronic problems, is increasing, resulting in a considerable rise in hospital admission rates, which is expected to boost the market growth. Moreover, as a result of high blood pressure, obesity, and smoking, a large percentage of the population is currently in danger of developing chronic diseases.

According to the WHO, chronic diseases are responsible for 60% of all fatalities worldwide, and every year, 17.9 million people die as a result of cardiovascular disorders. According to the same source, cancer is the leading cause of death globally, accounting for nearly one in every six deaths. As a result, increasing hospitalization, coupled with an increase in chronic illnesses, is likely to boost therapeutic bed installations, resulting in market growth. Furthermore, the increasing number of obesity cases is also anticipated to boost the market growth. Bariatric beds are specifically designed to handle obese patients.

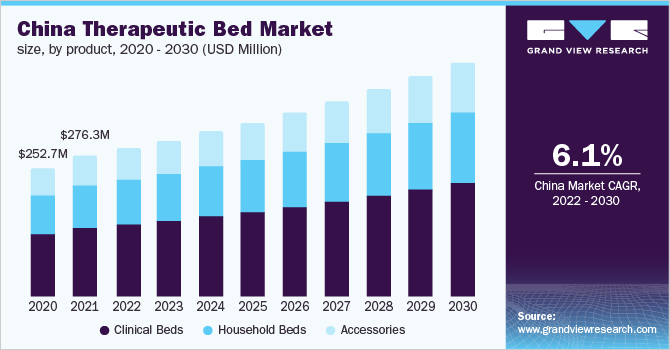

The incidence of obesity has increased significantly in the past few years, especially among the aged groups. For instance, as per the WHO, in 2016, more than 1.9 billion adults were overweight, out of which, around 650 million people were obese. These factors are expected to increase the demand for bariatric procedures. As per the report published by the CDC in 2020, the rates of obesity rose considerably among adults from 33.7% to 39.6% between the years 2015 & 2016 and 2019 & 2020. During this time, the rates of severe obesity also increased from 5.7% to 7.7%. China dominated the regional market in 2021.

The rising geriatric population in China and government initiatives to increase safety during treatment are among the key factors projected to drive the adoption of therapeutic beds. Furthermore, the ongoing expansion of medical infrastructure and increased government & private sector investments to promote the use of safer & more cost-effective healthcare solutions are among the factors driving the market growth. According to the National Health Commission, there were around 12,000 public hospitals and 21,000 private hospitals in 2018, with approximately 20,500 nonprofits and 12,600 for-profit institutions (excluding township and community hospitals). This is expected to create considerable opportunities for market players during the forecast period.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Bariatric Beds Market - The global bariatric beds market size was estimated at USD 282.13 million in 2022 and is estimated to expand at a CAGR of 5.1% from 2023 to 2030.

Hospital Furniture Market - The global hospital furniture market size was estimated at USD 9.11 billion in 2022, anticipated to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030.

Therapeutic Bed Market Segmentation

Grand View Research has segmented the global therapeutic bed market on the basis of product, application, end-use, and region:

Therapeutic Beds Product Outlook (Revenue USD Million, 2017 - 2030)

- Clinical Beds

- Household Beds

- Accessories

Therapeutic Beds Application Outlook (Revenue USD Million, 2017 - 2030)

- Acute Care Beds

- Critical Care Beds

- Long-term Beds

Therapeutic Beds End-use Outlook (Revenue USD Million, 2017 - 2030)

- Hospitals & Clinics

- Reproductive Care Centers

- Others

Therapeutic Beds Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Market Share Insights

December 2021: Baxter International, Inc., a global medical technology company, acquired Hill-Rom to create new opportunities for innovation, which will help reduce costs and improve care outcomes across the board.

October 2020: Stryker launched the industry’s first and only complete wireless hospital bed called ProCuity globally. This smart bed was created to reduce in-hospital patient falls at all levels of acuity, increase nursing workflow efficiencies & safety, and help hospitals save money.

Key Companies profiled:

Some prominent players in the global therapeutic bed market include:

- Hill Rom, Inc. (Baxter)

- Stryker Corp.

- Invacare Corp.

- Medline Industries

- Medical Depot, Inc.

- GF Health Products, Inc.

- Centromed Ltd.

- Arjo

- Amico Group of Companies

- Bakare Beds Ltd.

- Gendron, Inc.

- Hard Manufacturing Company, Inc.

Order a free sample PDF of the Therapeutic Bed Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment