Baby Powder Industry Overview

The global baby powder market size was valued at USD 1.09 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2028. The market is driven by the changing consumer preferences towards organic personal care products coupled with a rise in disposable income levels. Over the past few months, the pandemic has paused the demand for products in many sectors owing to disruptions in the supply chain, a drop in sales revenue, and the closure of several businesses across several industries. Factors, such as unemployment and financial insecurity, have shifted consumers’ preference towards major life events, such as childbirth and marriage.

According to the U.S. Centers for Disease Control and Prevention, the birth rate decreased by 4% during the pandemic. Companies in the market are innovating and introducing organic products to garner attention from the consumers. Owing to the pandemic, several consumers are opting for baby care products enriched with essential oils and natural ingredients. For instance, Bey Bee, a startup based in Gurgaon, India is offering safe and affordable baby care products in the Indian market.

Gather more insights about the market drivers, restraints and growth of the Global Baby Powder Market

The growing popularity of e-commerce channels has shifted the market dynamics across several regions. Several manufacturers are utilizing these channels to advertise their products. The capability to choose from a wide range of products coupled with attractive discounts has encouraged a number of consumers to shop online. In addition, companies are entering into partnerships with high-end luxury retailers to sell their products across various markets outside their base country.

The pandemic has impacted product demand. A rise in housing prices and increasing female employment rates are affecting the birth rates across several regions. The fertility rates have been falling in developed regions, such as North America and Europe. For instance, the Total Fertility Rate (TFR) in the U.S. fell from 2.1 to 1.6 from the year 2007 to 2020.

Browse through Grand View Research's Beauty & Personal Care Industry Related Reports

Baby Care Products Market - The global baby care products market size was valued at USD 18.17 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2021 to 2028.

Baby Diapers Market - The global baby diapers market size was valued at USD 82.59 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030.

Baby Powder Industry Segmentation

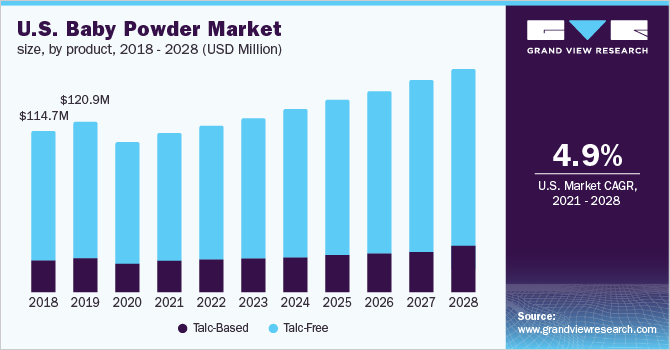

Grand View Research has segmented the global baby powder market based on product, distribution channel, and region:

Baby Powder Product Outlook (Revenue, USD Million, 2016 - 2028)

- Talc-based

- Talc-free

Baby Powder Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- Online

- Offline

Baby Powder Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Central & South America

- MEA (Middle East & Africa)

Market Share Insights:

January 2020: Moms & Co. launched a digital initiative to increase sales of its baby and pregnancy care products. Furthermore, the Himalaya Drug company has inaugurated mom and baby stores in Bengaluru. This move is expected to help the company gain a significant share in the Indian market.

Key Companies profiled:

Some prominent players in the global Baby Powder Industry include

- Johnson & Johnson Services Inc.

- Pigeon Corp.

- Prestige Consumer Healthcare

- Amishi Consumer Technology Pvt. Ltd.

- KCWW

- Artsana USA, Inc.

- Green Team Distribution

- The Clorox Company

- Himalaya Wellness Company

Order a free sample PDF of the Baby Powder Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment