Scooter Industry Overview

The global scooter market size was valued at USD 67.21 billion in 2021 and is projected to register a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030. The rapid rate of urbanization and improving road connectivity in emerging economies have created a high demand for transportation. The unavailability of public vehicles at remote locations encourages consumers to purchase personal vehicles. Consumers are looking for lightweight, easy-to-drive & operate, and economical vehicles; thus, scooters are widely preferred. Battery-powered electric scooters require no fuel and are free from vehicular pollution, fostering the scooter market.

Although various factors contribute to the scooter market's growth, the pandemic has severe impacts. Global lockdown, supply chain disruption, and limited transportation lead to low or no demand for the vehicle. There is a sharp decline in the sales of automobiles like scooters, both conventional and electric. Post-COVID-19, there has been a spike in demand for electric scooters, majorly from China and India. Thus, to cope with demand, scooter manufacturers are launching new vehicle ranges with the latest technologies in the market. In addition, they are working on enhancing the existing design, colors, weight, safety, and experience of the scooters to gain consumers' traction.

Gather more insights about the market drivers, restraints, and growth of the Global Scooter Market

Growing regulatory norms, a ban on internal combustion engine (ICE) vehicles, a lower import duty on electric vehicles, and improved battery charging infrastructure has shifted consumer preference. They are adopting electric scooters over conventional ones. Electric scooters are lightweight, easy to operate, and battery-powered; thus can be used for short-distance travel and local sightseeing. Further, the high mechanical efficiency, lower noise level, the lower total cost of ownership, and lesser maintenance of electric scooters propel their demand. Besides, there is rising adoption of electric scooters for sharing services in developed countries, which is expected to foster the growth of the scooters market.

The economic development of a country highly depends on its road connectivity. The governments of emerging nations are investing in building safe and reliable roads. Investment in road construction has brought new growth opportunities for the transportation and logistics sector. Many people in business have started entering the logistics market by setting up their firms or partnering with existing firms. Thus, they require vehicles to deliver goods at a minimum time and cost; scooters are one of the preferred vehicles. Scooters can escape the traffic and need less fuel than bikes, mopeds, and cars.

Furthermore, scooter manufacturers are majorly focusing on incorporating new technology into the vehicles to increase their speed, enhance battery efficiency, and make them cost-effective for customers. Besides, electric scooter manufacturers have introduced a range of scooters in emerging economies. For instance, Silence, a Spanish company, has introduced Silence 01 and 02 in South Africa; these models have fast charging features, load-carrying capacity, and removable batteries. Therefore, such strategies adopted by the automakers are expected to create new growth opportunities for scooters.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Electric Three Wheeler Market - The global electric three wheeler market size was valued at USD 829.5 million in 2021 and is anticipated to register a compound annual growth rate (CAGR)of 7.5 % during the forecast period.

Electric Scooters Market - The global electric scooters market size was estimated at USD 20.78 billion in 2021, and the market is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2022 to 2030.

Scooter Market Segmentation

Grand View Research has segmented the global scooters market based on product, type, and region:

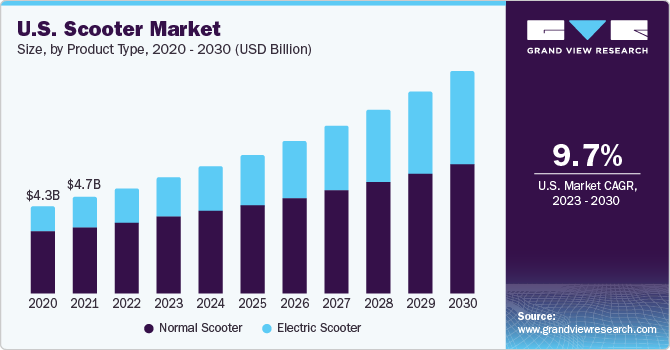

Scooter Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Normal Scooter

- Electric Scooter

Scooter Electric Scooter Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Conventional Electric Scooter

- Swappable Electric Scooter

Scooter Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

April 2022: Bird, an electric scooter manufacturer, launched an e-scooter in Helsinki. The scooter is incorporated with advanced safety features and has an IP68-rated waterproof battery.

May 2021: Bird Rides, Inc., introduced a next-generation scooter, “Bird Three,” with enhanced features, such as a diagnostic monitoring system and a longer-range battery in Berlin.

Key Companies profiled:

Some prominent players in the global Scooter market include

- Yadea Technology Group Co., Ltd.

- Ninebot Limited

- Neutron Holdings, Inc.,(Lime)

- Bird Rides, Inc.

- Spin

- Gotrax

- Segway Inc.

- Razor USA LLC

- Uber Technologies Inc. (Jump)

- OKIA

Order a free sample PDF of the Scooter Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment