Smart Home Security Camera Industry Overview

The global smart home security camera market size was valued at USD 6.42 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 18.7% from 2022 to 2030. Rapid growth in smart home penetration across North America is positively impacting the demand for smart home security cameras. According to a report by Security InfoWatch in July 2021, the U.S. has the highest smart home technology penetration rate in the world at 40.1%. Additionally, according to a study by Fixr, in 2019, 68% of people in the U.S. were familiar with smart security systems and 53% were most likely to own one.The COVID-19 pandemic has brought about a seismic shift in people’s attitudes toward wellness and security. The industry has been witnessing a few pivoting factors determining consumers’ spending on security devices i.e., working from home, conducting purchases through online platforms, and additional spending leeway realized from not having any outdoor leisure and travel expenditures.

The rapid adoption of IoT in smart homes is also supporting market growth. Consumers are shifting from traditionally mountable Wi-Fi cameras to the deployment of smart home security cameras to increase the security of their premises. These advanced smart home security cameras offer several benefits, which boost their installation in many households across the region. The ease of installation and easy availability of smart home security cameras drive the product demand.

Gather more insights about the market drivers, restraints and growth of the Global Smart Home Security Camera market

From smart lighting to smart thermostats, tech companies are making more intelligent products than ever before. The launch of new products with improved capabilities is favoring the market growth. Manufacturers have been focusing on developing new products for specific applications as there are varying demands based on the utilization and application of the devices.

Key players are taking the necessary steps to improve the accuracy and overall functionality of the devices. Although tech giants like Amazon, Google, and Apple are at the forefront, it is in the startup space where many of these new ideas and inventions are uncovered. For instance, in March 2020, Vivint Smart Home launched the Vivint Doorbell Camera Pro, an AI-powered doorbell camera that intelligently detects packages and actively helps protect them from porch pirates and other potential threats. The doorbell camera provides homeowners with peace of mind by helping to prevent crime before it happens.

Smart home tech startups are on the rise all over the world. However, like many other sectors, the majority of smart home tech companies are located in the U.S., which is home to 393 of such companies. Other leading countries include China, with 118, and the U.K. with 66. Germany and India also find themselves in the top-5 list, with 42 and 40 startups, respectively, as of 2021.

Browse through Grand View Research's Electronic & Electrical Industry Research Reports.

Smart Doorbell Market - The global smart doorbell market size was valued at USD 3,480.1 million in 2022 and is expected to register a compound annual growth rate (CAGR) of 33.4% from 2023 to 2030.

Robotic Vacuum Cleaner Market - The global robotic vacuum cleaner market size was valued at USD 4.48 billion in 2021 and is estimated to grow at a compound annual growth rate (CAGR) of 23.4% from 2022 to 2030.

Smart Home Security Camera Market Segmentation

Grand View Research has segmented the smart home security camera market based on product, application, and region.

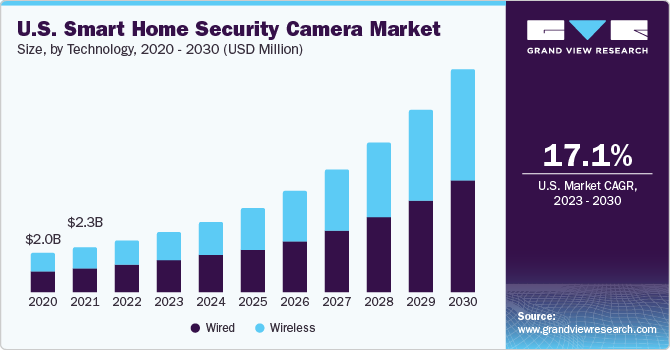

Smart Home Security Camera Product Outlook (Revenue, USD Million; 2017 - 2030)

- Wired

- Wireless

Smart Home Security Camera Application Outlook (Revenue, USD Million; 2017 - 2030)

- Doorbell Camera

- Indoor Camera

- Outdoor Camera

Smart Home Security Camera Regional Outlook (Revenue, USD Million; 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Central and South America

- Middle East and Africa

Market Share Insights

August 2021: SimpliSafe released the SimpliSafe Wireless Outdoor Security Camera, designed to help stop crime before it happens. With an adjustable magnetic mount, the SimpliSafe Outdoor Camera does not require any wiring and can be self-installed with ease in less than five minutes.

June 2020: Arlo Technologies, Inc. launched the Ultra Series of security cameras, the Ultra 2 Wire-Free Spotlight Camera System. The Ultra 2 delivers an enhanced user experience, building on advanced features such as 4K video with HDR, an ultra-wide 180-degree field of view, and more.

Key Companies profiled:

Some of the key players operating in the global home security camera market include:

- Vivint Smart Home, Inc.

- ADT LLC

- Simplisafe, Inc.

- Brinks Home Security

- iSmart Alarm, Inc.

- Live Watch Security LLC

- Skylinkhome

- Protect America, Inc.

- SAMSUNG ELECTRONICS Co., LTD.

- Frontpoint Security Solutions, LLC

- Arlo Technologies, Inc.

- Nest Labs

- Wyze Labs, Inc.

- Blink

- Ring LLC

Order a free sample PDF of the Smart Home Security Camera Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment