Micro-mobility Charging Infrastructure Industry Overview

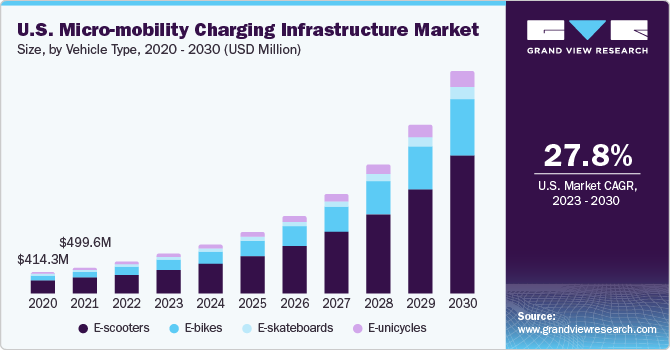

The global micro-mobility charging infrastructure market size was valued at USD 3.83 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 25.2% from 2022 to 2030. Increasing adoption of micro-mobility vehicles such as e-scooters and e-bikes to help reduce pollution and congestion, especially in crowded cities is a major factor driving the market growth. Micro-mobility is a better alternative to public transportation for countries worldwide focusing on solving their transportation problems rising concern of emissions from vehicles running on gasoline or diesel. Moreover, government subsidies and tax incentives aimed at encouraging the adoption of micro-mobility vehicles are further expected to create more growth opportunities for the market.

Rising applications of micro-mobility vehicles in the transportation and commercial sectors are presenting the need for a strong network of micro-mobility charging stations. In response to the rising demand, micro-mobility vehicle manufacturers are also focusing on offering charging networks across the globe. For instance, in November 2020, TIER, a German e-scooter startup, raised USD 250 million in a Series C funding round from SoftBank Vision Fund 2 to expand its presence in European cities. Such developments bode well for the growth of the micro-mobility charging infrastructure market over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Micro-mobility Charging Infrastructure Market

Leading players across the globe are offering innovative services to grow in the increasingly competitive market. For instance, in December 2020, Ola Electric Mobility Pvt Ltd announced the launch of its electric charging stations known as the Ola Hypercharger Network for its range of e-scooters across the world. The company has planned to develop 5,000 charging points across 100 cities in India to provide seamless charging for its e-scooters.

The demand for wireless charging stations for e-scooters and e-bikes has increased significantly in recent years. Several players are developing innovative products to enhance operational functionality and reduce the charging time of chargers. For instance, in May 2021, LG Electronics launched wireless charging stations in Bucheon, Seoul, in partnership with Olulo, Inc’s Kickgoing, a local e-scooter sharing service provider, to provide a better experience for e-scooter users.

The rapidly growing demand for shared mobility solutions is further expected to drive the market growth over the forecast period. Increasing traffic congestion, fuel cost, and rapidly shrinking parking spaces in emerging and developed countries have led to a greater demand for shared mobility solutions. Moreover, citizens prefer the use of shared mobility solutions as they are cheaper than other modes of transportation and eliminate the issues related to parking spaces. However, the high costs of setting up micro-mobility vehicle charging infrastructure could hamper the growth prospects of the market to a certain extent.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Electric Vehicle Charging Infrastructure Market - The global electric vehicle charging infrastructure market size was valued at USD 19.26 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 30.6% from 2022 to 2030.

Intelligent Transportation System Market - The global intelligent transportation system market size was valued at USD 28.25 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.3% from 2023 to 2030.

Micro-mobility Charging Infrastructure Market Segmentation

Grand View Research has segmented the global micro-mobility charging infrastructure market based on vehicle type, charger type, power source, end use, and region:

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

- E-scooters

- E-bikes

- E-unicycles

- E-skateboards

Charger Type Outlook (Revenue, USD Million, 2017 - 2030)

- Wired

- Wireless

Power Source Outlook (Revenue, USD Million, 2017 - 2030)

- Solar Powered

- Battery Powered

End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Commercial

- Residential

Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

January 2021: Zypp, an electric vehicle startup, announced that it is planning to set up 5,000 battery swapping stations in 100 cities across India.

October 2020: Swiftmile Inc introduced free solar-powered charging stations across various locations in the U.S.

Key Companies profiled:

Some prominent players in the global Micro-mobility Charging Infrastructure market include

- Ather Energy

- bike-energy

- Bikeep

- Flower Turbines

- Get Charged, Inc.

- Giulio Barbieri SRL

- Ground Control Systems

- Magment GmbH

- Perch Mobility

- Robert Bosch GmbH

- Solum PV

- SWIFTMILE

- The Mobility House GmbH

Order a free sample PDF of the Micro-mobility Charging Infrastructure Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment