U.S. Veterinarians Industry Overview

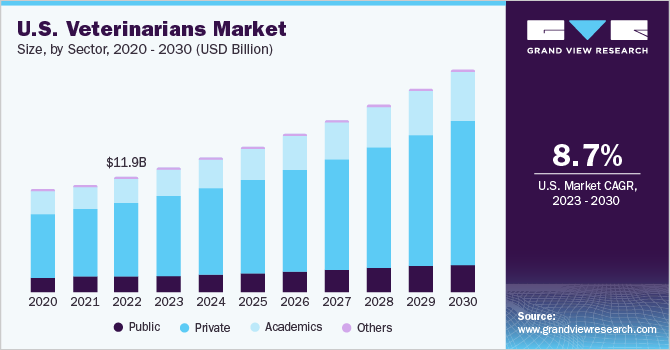

The U.S. veterinarians market size was valued at USD 11.03 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2030. The growing animal population, uptake of pet insurance, and expenditure on well-being of pets are the key market drivers. The demand for veterinary professionals is poised to increase in coming years, as retirement of existing ones is due. For instance, a survey conducted by the American Veterinary Medical Association (AVMA) in 2019 stated that around 20% of existing veterinarians were projected to retire in the following decade.

About 1 out of 3 professionals in this sector were identified to be a part of the baby boomer generation, and around 60% of these were estimated to be veterinary practice owners. As this generation retires, a notable amount of workforce is expected to exit the profession, thereby contributing to the demand for more veterinarians during the forecast period.

The COVID-19 pandemic resulted in a fall in the number of veterinary visits, practice revenue, and disruption in veterinary care delivery during the first few months of 2020. In March 2020, the U.S. FDA relaxed restrictions on veterinary telemedicine practices. As per new guidelines, veterinarian-client-patient relationship requirements were temporarily suspended. Veterinarians were also allowed to prescribe extra-label drugs and veterinary feed directive drugs after a remote examination & diagnosis of animals.

Various public, regulatory, nonprofit, and private health institutions released guidelines to ensure continuity of care for animals during the pandemic. These included AVMA, FDA, and CDC. The CDC, for instance, released interim guidelines for prevention and control of infection for veterinary clinics treating pets during the pandemic.

The veterinary services sector had been facing retention challenges for a long time as a result of the emotional toll of work and intense work hours. The rise in demand for veterinary services during the pandemic highlighted the crucial need for greater number of skilled veterinarians. The pandemic also exacerbated workflow burdens, as many patient visits were either deferred or canceled during the first half of 2020, thus creating a backlog when services resumed.

Gather more insights about the market drivers, restraints and growth of the U.S. Veterinarians Market

The loss of staff members due to sickness or burnout is estimated to have further contributed to demand for veterinarians across the U.S., to ensure continued provision of quality patient care. This demand is estimated to continue post-COVID. The pandemic escalated the digitalization of veterinary care as veterinarians began adopting telemedicine to ensure business continuity, while following social distancing norms. Furthermore, growing initiatives by market players fueled the digital transition of vet care services.

For instance, in October 2020, in response to the COVID-19 pandemic, Guardian Vets launched Curbside, a safe and contactless appointment solution for pet owners. This expanded the company’s offerings while allowing vet clinics and hospitals to treat patients in-line with social distancing protocols. In September 2020, TeleVet launched ClinicConnect, an online veterinary solution, to support clinics operating during the COVID-19 pandemic.

Supportive initiatives undertaken by the government are expected to facilitate the growth of the market in the coming years. For instance, the Veterinary Services Grant Program is intended to support veterinary services and veterinarian shortage situations. It comprises of 2 types of grants. These include the Rural Practice Enhancement (RPE) grants and Education, Extension, and Training (EET) grants.

During FY 2021, about 3 million in funds were distributed to the selected grant applicants. Some of the initiatives funded by the program in 2021 include the Iowa State University’s expansion of rural veterinary practice in organic and non-conventional livestock through continuing education, and the Virginia Polytechnic Institute & State University’s ‘Training the Veterinary Public Practitioner’ project.

Browse through Grand View Research's Animal Health Industry Related Reports

Veterinary Telemetry Systems Market - The global veterinary telemetry systems market size was estimated at USD 271.9 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.59% from 2022 to 2030.

Veterinary Care Market - The global veterinary care market size was valued at USD 74.7 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2021 to 2028.

U.S. Veterinarians Market Segmentation

Grand View Research has segmented the U.S. Veterinarians market on the basis of sector:

U.S. Veterinarians Sector Outlook (Revenue, USD Million, 2017 - 2030)

- Public

- Private

- Academics

- Others

Order a free sample PDF of the U.S. Veterinarians Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment