Europe Molded Pulp Packaging Industry Overview

The Europe molded pulp packaging market size was valued at USD 924.2 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2020 to 2028. Rising demand for sustainable products for the packaging of eggs, fruits, and other fresh produce in Europe is expected to fuel the growth of the market. Eggs are packaged in molded pulp trays and clamshells, which are then sold to restaurants, foodservice operators, and individual consumers. Per capita, egg consumption has been increasing on a yearly basis in Europe on account of the health benefits and increasing demand for protein-rich food in Europe. The egg packaging is therefore expected to be one of the major factors augmenting the market growth.

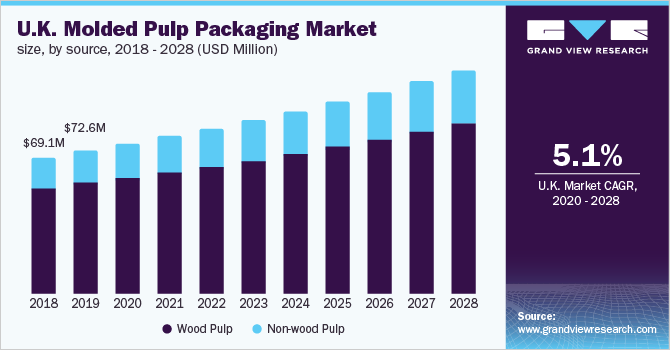

Wood-based molded pulp packaging held the largest revenue share in the U.K. market in 2020 with the rising availability of recycled paper in the country used as a raw material. According to National Packaging Waste Database, the current recycling rate of paper is around 80.0% in the country. The government in the country is focusing on increasing the paper waste recycling rate to 100% across the U.K. in the near future, thereby supporting the market growth.

Gather more insights about the revenue drivers, restraints and growth of the Europe Molded Pulp Packaging market

Molded pulp packaging is a potential alternative to plastic trays and clamshells and thus can contribute to reducing plastic waste generation. According to the EU, about 17.2 million metric tons of plastic packaging waste were generated in the EU between 2005 and 2020. Thus, the regulatory bodies and governments in Europe have imposed stringent restrictions on the generation of primarily plastic waste over the years.

The new Circular Economy Action Plan was released by European Union (EU) in March 2020, under which, it has set a target of ensuring that all the EU markets utilize reusable and recyclable packaging by 2030 in an economically viable manner. Several retail chains and foodservice operators in the region have set targets for phasing out plastic packaging products. Thus, the aforementioned factors are anticipated to drive the demand for sustainable molded pulp packaging over the forecast period.

The COVID-19 outbreak in the year 2020 negatively impacted the foodservice industry. The restaurants, bars, and takeaways wavered between partial and total closure in Europe initially in 2020. Lockdown measures across Europe led to a fall in demand from the foodservice industry; however, food retail and home deliveries witnessed a spike during the initial phase of the pandemic in 2020.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Molded Pulp Packaging Market - The global molded pulp packaging market size was estimated at USD 4.80 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2030.

Plastic Packaging Market - The global plastic packaging market size was valued at USD 355.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2022 to 2030.

Europe Molded Pulp Packaging Industry Segmentation

Grand View Research has segmented the Europe molded pulp packaging market on the basis of source, packaging type, application, and region:

Europe Molded Pulp Packaging Source Outlook (Revenue, USD Million, 2017 - 2028)

- Wood Pulp

- Non-wood Pulp

Europe Molded Pulp Packaging Type Outlook (Revenue, USD Million, 2017 - 2028)

- Thick Wall

- Transfer

- Thermoformed

- Processed

Europe Molded Pulp Packaging Application Outlook (Revenue, USD Million, 2017 - 2028)

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

Market Share Insights:

June 2021: AR Packaging partnered with PulPac to fast-track its production for sustainable molded pulp products.

December 2019: Huhtamaki introduced the Future Smart Duo fiber lid, which is a sustainable packaging product for hot and cold beverages and is manufactured using a mixture of wood fibers and bagasse.

Key Companies profiled:

Some prominent players in the Europe Molded Pulp Packaging Industry include

- Brodrene Hartmann A/S

- Omni-Pac Group

- Huhtamaki

- Pulp-Tec Limited

- Eco-Products, Inc.

- TART

- PAPACKS Sales GmbH

- Kiefel Packaging

- Switch Packaging Specialists Ltd.

- AR Packaging

Order a free sample PDF of the Europe Molded Pulp Packaging Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment