Core Banking Software Industry Overview

The global core banking software market size was valued at USD 10.89 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. The growth can be attributed to the increasing customer demand for advanced banking technologies. Moreover, the increasing demand for a digital banking experience from Gen Z and millennials is transforming how the banking industry operates. The increasing consumer demand to access banking services from digital channels has led to a surge in advanced banking technologies. These factors are expected to drive the growth prospects of the market over the forecast period.

The increasing demand for effectively managing customer banking accounts from a single platform is further expected to drive market growth over the forecast period. Core banking solutions empower bank employees with an accurate insight into the bank account through an end-to-end platform. This platform spans business lines and combines capabilities such as customer onboarding, Customer Relationship Management (CRM), account opening, loan origination, workflow, credit analysis, deposit accounts, instant reporting, and enterprise content management capabilities. Furthermore, core banking solutions integrate the bank's transactional and core systems while replacing manual processes and point solutions.

Gather more insights about the market drivers, restraints, and growth of the Global Core Banking Software Market

Banks across the globe are focusing on adopting Artificial Intelligence (AI)-integrated core banking solutions to extract usable insights of customers in real-time. These solutions are enabling banks to achieve higher operational efficiencies and analyze transactions more effectively, detect fraudulent activities, mitigate risks, and understand and predict customer behavior. This enhanced ability to analyze complex data sets enables banks to make informed decisions for their banking products, operations, and services.

Core banking solutions work as a back-end office system. Banks are focusing on adopting core banking solutions to effectively manage all the banking transactions, provide customers with better services, and empower the customer. Moreover, the integration of such advanced technology enables bank customers to have an efficient and hassle-free experience while accessing bank services.

However, the lack of awareness about core banking technology among several banks and financial institutions could hamper the market growth. Moreover, the various privacy concerns associated with banking systems are further anticipated to hinder the market growth over the forecast period. With the increasing popularity of core banking technology, security concerns about application vulnerabilities, unencrypted data, information loss, and mobile malware are also increasing. These concerns can impact the revenues of corporate banks, credit unions, and financial institutions.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Autonomous Finance Market - The global autonomous finance market was valued at USD 14.57 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2022 to 2030.

Retail Core Banking Solution Market - The global retail core banking solution market size was valued at USD 4.07 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.8% from 2022 to 2030.

Core Banking Software Industry Segmentation

Grand View Research has segmented the global core banking software market based on solution, service, deployment, end-use, and region:

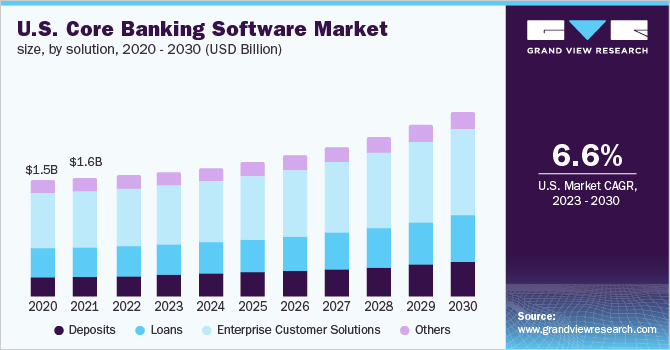

Core Banking Software Solution Outlook (Revenue, USD Million, 2017 - 2030)

- Deposits

- Loans

- Enterprise Customer Solutions

- Others

Core Banking Software Service Outlook (Revenue, USD Million, 2017 - 2030)

- Professional Service

- Managed Service

Core Banking Software Deployment Outlook (Revenue, USD Million, 2017 - 2030)

- Cloud

- On-premise

Core Banking Software End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Banks

- Financial Institutions

- Others

Core Banking Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

October 2020: Finastra launched Fusion Payments To Go, a pre-packaged payment solution, to implement domestic and cross-border payment services in small and medium-sized banks across the U.S., Europe, and South Africa. This solution provides better functionalities and operating rules to support clearing and settlement mechanisms, improve customer experience, and deliver revenue growth.

Key Companies profiled:

Some prominent players in the global Core Banking Software Industry include

- Capgemini

- Finastra

- FIS

- Fiserv, Inc.

- HCL Technologies Limited

- Infosys Limited

- Jack Henry & Associates, Inc.

- Oracle Corporation

- Temenos Group

- Unisys

Order a free sample PDF of the Core Banking Software Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment