Mobile Payment Industry Overview

The global mobile payment market size was valued at USD 52.21 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 36.2% from 2023 to 2030. The global mobile payments transactions were valued at over USD 2 Trillion in 2022. The market growth can be attributed to factors such as the rising m-commerce industry and the surge in the penetration of smartphones across the globe. The increasing internet penetration for online shopping is expected to further propel market growth over the forecast period. Businesses across the globe are making their payment modes mobile-compatible, thereby creating growth opportunities for the market.

Mobile payment solutions are fast and convenient. An increasing number of customers across the globe have embraced the concept of using smartphones and tablets to pay for products and services. Moreover, both e-commerce and traditional businesses are focusing on adapting to changing customer behavior, including cashless payment methods through mobile devices, due to the challenges posed by the COVID-19 pandemic. These aforementioned factors are expected to fuel the market growth over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Mobile Payment Market

In mobile payment technology, Near-Field Communication (NFC) effectively transmits encrypted data to the Point of Sale (POS) devices directly and instantly. This saves time significantly compared to PIN and chip technology. NFC in mobile devices makes use of close-proximity radio frequency identification to effectively communicate with NFC-enabled card machines. Customers need not come into physical contact with the POS devices to transfer information and only the mobile devices need to be near the terminal.

The increasing adoption of sound wave-based mobile payments is expected to drive market growth. Instead of using existing technologies, such as banking applications or mobile wallets, NFC, or card terminals, sound wave-based payment transactions are processed through unique sound waves containing encrypted information about the payments. The internet is not required for sound wave-based mobile payments. Sound wave-based mobile payment solutions are easy to deploy at a low cost, particularly in regions and countries where residents cannot afford the most advanced smartphones.

However, security concerns related to mobile payment solutions are expected to hinder the growth of the market. The increasing number of high-profile data breaches across the globe is expected to hamper the growth of the mobile payment market over the forecast period. Customers prefer to use debit or credit cards since most customers choose to stay secure from data breaches while making payments. Some customers are still more comfortable using debit or credit cards rather than making a contactless payment.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Contactless Payment Market - The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030.

Mobile Payment Market - The global mobile payment market size was valued at USD 52.21 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 36.2% from 2023 to 2030.

Mobile Payment Market Segmentation

Grand View Research has segmented the global mobile payment market based on technology, payment type, location, end-use, and region:

Mobile Payment Technology Outlook (Revenue, USD Billion, 2017 - 2030)

- Near Field Communication

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Interactive Voice Response System

- Mobile App

- Others

Mobile Payment Type Outlook (Revenue, USD Billion, 2017 - 2030)

- B2B

- B2C

- B2G

- Others

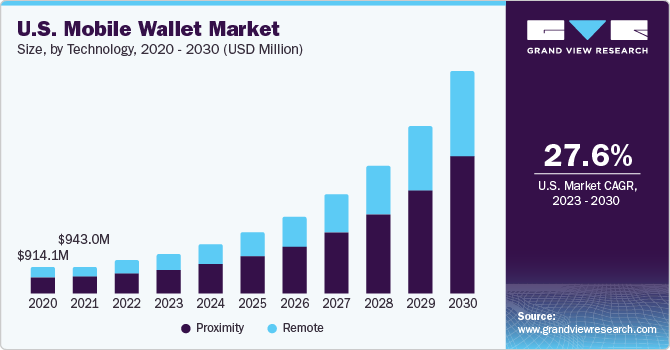

Mobile Payment Location Outlook (Revenue, USD Billion, 2017 - 2030)

- Remote Payment

- Proximity Payment

Mobile Payment End-use Outlook (Revenue, USD Billion, 2017 - 2030)

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Transportation

- Others

Mobile Payment Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

July 2022: Damen ePayment launched its mobile wallet app in collaboration with BKN301. BKN301 is a financial technology company that develops Cashflo, banking-as-a-service functionalities, and payment services.

September 2021: PayPal Holdings, Inc. announced that it has settled to acquire Paidy, for USD2.7 billion, principally in cash. The acquisition is expected to increase PayPal's capabilities, relevance, and distribution in the domestic payments market in Japan. Paidy would continue to operate its present business, maintain its support, and brand an extensive variety of consumer wallets and marketplaces.

Key Companies profiled:

Some prominent players in the global Mobile Payment market include

- Google (Alphabet Inc.)

- Alibaba Group Holdings Limited

- Amazon, Inc.

- Apple Inc.

- American Express Company

- M Pesa

- Money Gram International

- PayPal Holdings Inc.

- Samsung Electronics Co. Ltd.

- Visa Inc.

- WeChat (Tencent Holdings Limited)

Order a free sample PDF of the Mobile Payment Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment