Fermented Tea Industry Overview

The global fermented tea market size was valued at USD 3.9 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 15.8% from 2021 to 2028. Rising awareness towards gut health and improvement of immunity levels, rise in disposable income, and inclination towards organic products are expected to drive the market. Additionally, the pandemic has accelerated the demand for immunity-boosting products. Also, consumers are preferring sparkling drinks as a substitute over alcohol as it provides a similar amount of tartness. In 2020, Kombucha Brewers International (KBI) released code practices for kombucha manufacturers to create transparency among consumers.

Companies in the industry are increasing their production abilities by expanding their product line and partnering with retail stores and supermarkets to increase their presence in the market. The rising usage of teas as meal accompaniment is also helping companies to expand their reach in bars and taverns. Several grocery stores also offer fermented drinks in aisles with other vegan and organic products. Several players in the market have partnered with retail outlets such as Whole Foods, Walmart, and many others. Supermarkets and local stores offer customers a wide range of brands and flavors. For example, Whole Foods in New York has collaborated with local sellers for providing flavors such as watermelon basil kombucha on tap.

Gather more insights about the market drivers, restraints, and growth of the Global Fermented Tea Market

The growing interest in probiotic foods is driving the demand for fermented tea. For example, as per Loving Foods, close to 50,000 residents in the U.K. search the internet for fermented foods such as sauerkraut and kimchi. Rising initiatives to curb the sale of sugary drinks have led to a rise in sales for sugar-free beverage offerings in the country. Customers in the country are preferring beverages that promote sustainability and veganism. Also, as per Food Spark, supermarkets and the regional stores in the region are keen on displaying fermented foods and beverages on the aisles. Several beverage buyers are looking for plant-based fermented products and new emerging products in this space. Overall, these above factors are fueling the demand for fermented teas in the country.

Browse through Grand View Research's Consumer F&B Industry Related Reports

Goat Milk Products Market - The global goat milk products market size was estimated at USD 12.45 billion in 2022 and is expected to expand at compounded annual growth rate (CAGR) of 4.7% from 2023 to 2030.

Hemp Seed Oil Market - The global hemp seed oil market was valued at USD 88.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 14.7% from 2023 to 2030.

Fermented Tea Industry Segmentation

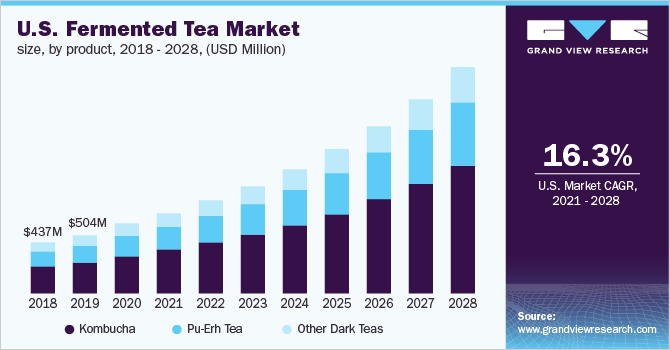

Grand View Research has segmented the global fermented tea market based on product, distribution channel, and region:

Fermented Tea Product Outlook (Revenue, USD Million, 2016 - 2028)

- Kombucha

- Pu-Erh Tea

- Other Dark Teas

Fermented Tea Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- Online

- Offline

Fermented Tea Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Central & South America

- MEA (Middle East & Africa)

Key Companies profiled:

Some prominent players in the global Fermented Tea Industry include

- Buddha Teas

- KeVita

- Live Soda LLC

- Humm Kombucha

- GT’s Living Foods

- Mandala Tea

- Menghai Tea Factory

- Born Teas

- Hunan Provincial Baishaxi Tea Industry Co., Ltd.

Order a free sample PDF of the Fermented Tea Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment