Molecular Diagnostics Industry Overview

The global molecular diagnostics market size was valued at USD 37.04 billion in 2021 and is expected to decline at a compound annual growth rate (CAGR) of -1.6% from 2022 to 2030. The shrinking of the market can be attributed to the decline in demand for molecular COVID-19 testing during the forecast period. However, factors such as technological advancements, rising elderly population, and increasing demand for genetic testing is boosting the growth of the market. In addition, rising demand for PoC testing can be attributed to increasing demand for self-testing diagnostics, and patient awareness about faster diagnostics.

The outbreak of COVID-19 impelled the diagnostics industry into action, with a race to develop novel and rapid diagnostics kits for the detection of coronavirus. The pandemic led to a spike in the revenue of companies operating in the infectious diseases segment. For instance, in April 2021, a 59% rise in revenue was reported by Thermo Fisher Scientific, owing to the diagnostics division that delivered 150% growth. However, with the rising number of vaccinations globally, the demand for diagnostics for COVID-19 testing is likely to decline during the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Molecular Diagnostics market

The rising geriatric population globally is increasing the risk of getting numerous diseases including cancer, cardiovascular diseases, obesity, neurological disorders, and diabetes. According to a UN report, in 2020, there were about 727 million people aged 65 years & above globally. In addition, the number of individuals aged 80 and above is projected to double by 2050, that is, to cross more than 1.5 billion. The fact that the global geriatric population is expected to grow over the forecast period is anticipated to be a high-impact rendering driver of the market.

The geriatric population is more likely to suffer from COVID-19 due to decreased immune function, multimorbidity, and physiological changes associated with aging. According to WHO Regional Director for Europe, till April 2020, around 95% of the deaths were reported among patients 60 years or above. Furthermore, more than 50% of deaths occurred in patients aged 80 years or older.

In addition, the growing incidence of infectious diseases is expected to propel market growth over the forecast period. Moreover, the growing incidence of STIs, such as HIV and HPV, is expected to expand the target population, thereby boosting the market growth. According to WHO, globally, in 2020, the prevalence and incidence of HIV were approximately 37.7 million and 1.5 million, respectively. Furthermore, people suffering from HIV are highly susceptible to other infections such as tuberculosis, which is the leading cause of death among HIV-affected people.

The rising initiatives by market players to improve access to cost-effective resources are anticipated to drive the molecular diagnostics market growth. Molecular diagnostics render accurate & effective results and has indispensable applications in disease diagnostics. However, high prices associated with molecular tests are one of the major factors impeding this market.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

Rapid Tests Market - The global rapid tests market size was valued at USD 1.29 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2023 to 2030.

Body Fluid Collection And Diagnostics Market - The global body fluid collection and diagnostics market size was valued at USD 30.19 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030.

Molecular Diagnostics Market Segmentation

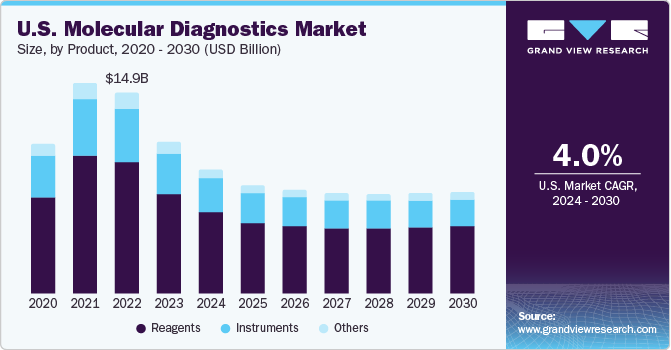

For this report, Grand View Research has segmented the global molecular diagnostics market based on product, test location, technology, application, and region:

Product Outlook (Revenue, USD Million, 2017 - 2030)

- Instruments

- Reagents

- Others

Test Location Outlook (Revenue, USD Million, 2017 - 2030)

- Point-of-Care

- Self-test or Over the Counter

- Central Laboratories

Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Polymerase chain reaction (PCR)

- In Situ Hybridization (ISH)

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Chips and Microarrays

- Mass Spectrometry

- Sequencing

- Transcription Mediated Amplification (TMA)

- Others

Application Outlook (Revenue, USD Million, 2017 - 2030)

- Oncology

- Pharmacogenomics

- Infectious Diseases

- Genetic Testing

- Neurological Disease

- Cardiovascular Disease

- Microbiology

- Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

December 2021: Roche completed the acquisition of TIB Molbiol Group. TIB Molbiol Group has around 45 CE-IVD approved assays for the diagnosis of infectious diseases, inherited genetic testing, transplant medicine, and hematology testing.

May 2021: Roche acquired GenMark Diagnostics for USD 1.8 billion. This acquisition will help Roche expand its molecular diagnostics portfolio.

Key Companies profiled:

Some of the prominent players in the Molecular Diagnostics market include:

- BD

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Abbott

- Agilent Technologies, Inc.

- Danaher

- Hologic Inc. (Gen Probe)

- Illumina, Inc.

- Johnson & Johnson Services, Inc.

- Grifols, S.A.

- QIAGEN

- F. Hoffmann-La Roche, Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

Order a free sample PDF of the Molecular Diagnostics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment