Surgical Navigation Systems Industry Overview

The global surgical navigation systems market size was valued at USD 6.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 14.2% from 2022 to 2030. The rising prevalence of target disorders such as osteoarthritis, brain cancer, and ENT disorders along with the increasing geriatric population is expected to propel the growth. According to the World Health Organization (WHO), 9.6% of men and 18% of women suffer from various forms of arthritis. Osteoarthritis generally affects the geriatric population. Most osteoarthritis patients have difficulty in movement and are unable to perform daily activities.

Furthermore, the rising demand for minimally invasive surgeries is another factor responsible for escalating the adoption of these devices over the forecast period. Minimally invasive surgeries involve lesser incision wounds leading to quicker recovery time, shortened hospitals stay, and enhanced patient comfort. Moreover, these procedures are economically viable due to the shorter duration of hospital stays. The amount of blood loss during minimally invasive surgeries is lesser than the conventional open surgeries. Technological advancements in these procedures and the introduction of new products are expected to further drive the market.

Gather more insights about the market drivers, restraints, and growth of the Global Surgical Navigation Systems market

An unprecedented rise in the population aged 60 years and above is anticipated to increase the demand for hip and knee replacement surgeries. This factor is expected to positively influence market growth. Furthermore, the presence of a supportive regulatory structure is also anticipated to drive the overall growth of the market and the demand for surgical navigation systems. Rising reimbursement coverage for orthopedic procedures, such as knee replacement is expected to fuel the adoption of these systems by the surgeons in near future.

Facing the outbreak of COVID-19, the medical setting across the globe has changed dramatically, offering unprecedented challenges to routine clinical practice. Owing to restrictions on elective procedures, the pandemic has significantly impacted the surgical navigation system market. As restrictions resulted in delays to a number of procedures. There was a 25–75% reduction in elective surgery in Japan. However, other factors, such as the demand for better patient outcomes will drive the uptake of novel technologies in navigation-assisted surgeries and support market growth. For instance, in February 2021, Royal Philips announced the introduction of ClarifEye Augmented Reality Surgical Navigation for minimally invasive spine procedures

Browse through Grand View Research's Medical Devices Industry Research Reports.

Orthopedic Braces and Supports Market - The global orthopedic braces and supports market size was valued at USD 4.06 billion in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 6.5% from 2022 to 2030.

Neurology Clinical Trials Market - The global neurology clinical trials market size was valued at USD 5,235.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030.

Surgical Navigation Systems Market Segmentation

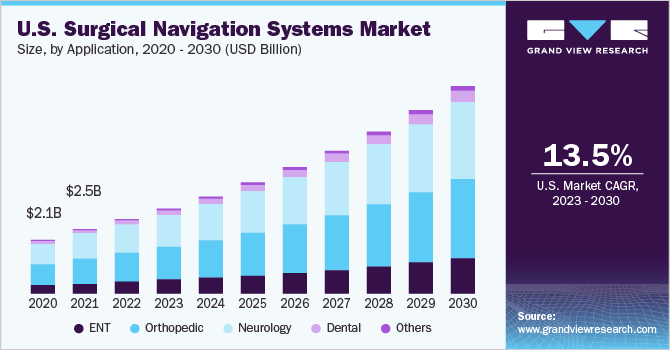

Grand View Research has segmented the global surgical navigation systems market based on application, technology, end use, and region:

Surgical Navigation Systems Application Outlook (Revenue, USD Million, 2017 - 2030)

- ENT

- Orthopedic

- Neurology

- Dental

- Others

Surgical Navigation Systems Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Electromagnetic

- Optical

- Others

Surgical Navigation Systems End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals

- Ambulatory Surgical Centers

Surgical Navigation Systems Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

November 2020: Stryker completed the acquisition of Wright Medical, in an attempt to enhance its global market position in trauma and extremities, providing significant opportunities to improve outcomes, advance innovation, and increase patient reach.

September 2019: Johnson & Johnson's DePuy Synthes successfully signed an agreement with JointPoint, Inc. According to this agreement, DePuy Synthes acquired the latter's navigation software, which would allow surgeons to improve surgical outcomes in hip arthroplasties.

Key Companies profiled:

Some of the prominent players in the Surgical Navigation Systems market include:

- B. Braun Melsungen AG

- Stryker

- Medtronic

- Corin

- Siemens Healthineers

- Smith+Nephew

- Johnson & Johnson Services, Inc. (DePuy Synthes)

- Zimmer Biomet

- KARL STORZ SE & Co. KG

- Amplitude Surgical

Order a free sample PDF of the Surgical Navigation Systems Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment