Vibration Sensor Industry Overview

The global vibration sensor market size was valued at USD 5.32 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2022 to 2030. The benefits offered by vibration sensors, including low cost, simple installation, and good response at high frequencies, are expected to drive market growth. The high vibration levels of robotic machinery in high-end industrial applications are expected to create the demand for accelerometers. Accelerometers are capable of controlling the damage caused to critical materials during high-speed operations, such as milling and cutting. The rising demand for Micro-Electromechanical System (MEMS)-based vibration sensors across various industries, such as automobile and aerospace & defense, is driving the market growth.

In response to the rising demand, vendors are making efforts to launch enhanced MEMS-based sensors to strengthen their market position. For instance, in May 2021, STMicroelectronics announced the launch of the next-generation MEMS three-axis linear accelerometer, AIS2IH. This accelerometer can bring enhanced temperature stability, resolution, and mechanical robustness to automotive applications, such as telematics infotainment. The growing integration of enhanced technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT) in vibration sensors is creating opportunities for market growth. As a result, several vibration sensor providers are embedding AI technology in their products.

Gather more insights about the market drivers, restraints, and growth of the Global Vibration Sensor Market

For instance, in September 2021, Reality Analytics Inc. announced that it would partner with Fujitsu Component Ltd. to bring Fujitsu Component Ltd.’s contactless vibration sensor to industrial and manufacturing applications. Through this partnership, the former company is expected to demonstrate AI-enabled contactless vibrating sensing based on Doppler radar. Researchers globally are focusing on bringing enhancements to accelerometers. For instance, in March 2021, the National Institute of Technology (NIST) researchers developed a new type of accelerometer that is based on opting mechanical and lasers principles. This sensor consists of a pair of silicon chips and could find use in spacecraft and aircraft, self-driving cars, tablets, and smartphones.

In addition, it could also be used in navigation systems where GPS is not available, such as satellites and submarines. The Inertial Measurement Unit (IMU) is being increasingly used in autonomous cars in recent years, creating a new opportunity for market growth. The IMU consists of a gyroscope and accelerometer and is capable of measuring the angular rate and gravity of an object to which it is attached. The IMU is used in automotive vehicles across applications, such as Advanced Driver-assistance Systems (ADAS), electronic stability control, and lane-keeping assistance. The rising demand for autonomous vehicles across countries, such as the U.S., the U.K., and Germany, due to government efforts will also drive market growth.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Distributed Fiber Optic Sensor Market - The global distributed fiber optic sensor market size was valued at USD 1,292.7 million in 2021, according to a new report by Grand View Research, Inc. The market is expected to register a compound annual growth rate (CAGR) of 7.3% from 2022 to 2030.

Agriculture Sensor Market - The global agriculture sensor market size was valued at USD 1.34 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 13.6% from 2021 to 2028.

Vibration Sensor Market Segmentation

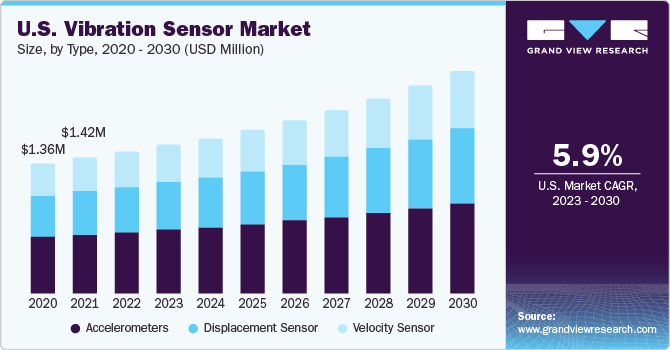

Grand View Research has segmented the global vibration sensor market based on type, technology, material, end-use, and region:

Vibration Sensor Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

- Accelerometers

- Velocity Sensor

- Displacement Sensor

Vibration Sensor Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

- Piezoresistive

- Strain Gauge

- Variable Capacitance

- Hand Probe

- Optical

- Tri-Axial

- Others

Vibration Sensor Material Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

- Doped Silicon

- Piezoelectric Ceramics

- Quartz

Vibration Sensor End-use Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

- Automobile

- Consumer Electronics

- Healthcare

- Aerospace & Defense

- Oil & Gas

- Others

Vibration Sensor Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

October 2021: Fluke Reliability, a machine conditioning devices provider, partnered with Everactive, a technology company, to develop wireless vibration sensors.

April 2021: Advantech and RAD, IoT technology providers, partnered with Actility, a LoRaWAN Network Server provider.

Key Companies profiled:

Some prominent players in the global Vibration Sensor market include

- ASC GmbH

- Analog Devices, Inc.

- Dytran Instruments Inc.

- Honeywell International Inc.

- Hansford Sensors

- Safran Colibrys SA

- National Instruments Corp.

- TE Connectivity

- Bosch Sensortec GmbH

- Baumer

Order a free sample PDF of the Vibration Sensor Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment