Used Car Industry Overview

The global used car market size was valued at USD 1.57 trillion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030. The used car shipment was recorded at 120.3 million units in 2021. The market has witnessed significant growth in the last few years as the price competitiveness among the new players has been one glowing spot in the used car industry. The inability of customers to buy new cars became one of the reasons for the growing used cars sales volume, which is complemented by the investments made by the industry participants to establish their dealership network in the market. These dealership networks helped market participants to brand and make used car options viable.

Further, the role of online sales has become a critical growth factor in the market. Online sites in auto marketplaces have played an essential role in bringing access to consumers with a single touch. A combination of such developments created a significant upsurge in the demand for used cars. In addition, the factors such as affordability, the availability of used cars, the hike in the need for personal mobility, and the emergence of various online players to organize the market have resulted in the growth of the market growth. For instance, in 2019, Ebay Inc. launched a new eBay Motors application to enhance the used car sale and purchase process online.

Gather more insights about the market drivers, restraints, and growth of the Global Used Car Market

Until recently, automobile manufacturers and dealers have mainly focused on their new vehicle business with the exclusion of used cars, often viewed as a byproduct. However, the competition in the market and the threat of new entries have created a great extent of an upsurge in the used car dealership. Moreover, the added quality and reliability of used cars changed the consumer attitude and increased the sales of the used passenger cars. Investing in used car management has become one of the market's requirements characterized by a slimming margin, relentless competition, and demanding consumers.

Technological advancements such as the development of the internet and the introduction of hybrid and electric vehicles have changed the buyer position in the market. Moreover, consumers are now knowledgeable about the vehicle, their residual value, quality finance charges, availability, the price applied, and sometimes, the profit margin that the seller makes in a closing deal. This knowledge has changed the dynamics and managed to turn customer intelligence to their advantage. Resultantly, consumers are more inclined toward buying used cars nowadays.

Some of the key factors including transparency and symmetry of the information among the consumers and buyers, the online sales channel growth, certified used vehicle programs, and the strong position of franchise dealers play a vital role in driving the market for used cars. Various leading companies have set up online and offline stores worldwide to offer seamless used car buying experiences. For instance, in September 2020, AutoNation Inc. expanded its pre-owned vehicle store and opened two new stores in the USA Denver market. The organization also announced its goal to open 130 AutoNation Inc. stores in operation across the USA by 2026.

In both developed and developing countries, the used to new vehicle ratio has increased in the last few years, accounting for the reasons stated earlier. In addition, franchised dealers with support from OEM involvement in certification and marketing programs, online inventory pooling, and access to high-quality contracts are in a strong position to benefit from the growth in the market.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Intelligent Transportation System Market - The global intelligent transportation system market size was valued at USD 28.25 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.3% from 2023 to 2030.

Commercial Vehicles Market - The global commercial vehicles market size was estimated at USD 1.35 trillion in 2022 and is projected to register a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030.

Used Car Industry Segmentation

Grand View Research has segmented the global used car market based on vehicle type, vendor type, fuel type, size, sales channel, and region:

Used Car Vehicle Type Outlook (Shipment, Million Units; Revenue, USD Billion, 2017 - 2030)

- Hybrid

- Conventional

- Electric

Used Car Vendor Type Outlook (Shipment, Million Units; Revenue, USD Billion, 2017 - 2030)

- Organized

- Unorganized

Used Car Fuel Type Outlook (Shipment, Million Units; Revenue, USD Billion, 2017 - 2030)

- Diesel

- Petrol

- Others

Used Car Size Outlook (Shipment, Million Units; Revenue, USD Billion, 2017 - 2030)

- Compact

- Mid-Sized

- SUV

Used Car Sales Channel Outlook (Shipment, Million Units; Revenue, USD Billion, 2017 - 2030)

- Offline

- Online

Used Car Regional Outlook (Shipment, Million Units; Revenue, USD Billion, 2017 - 2030)

- North America

- Europe

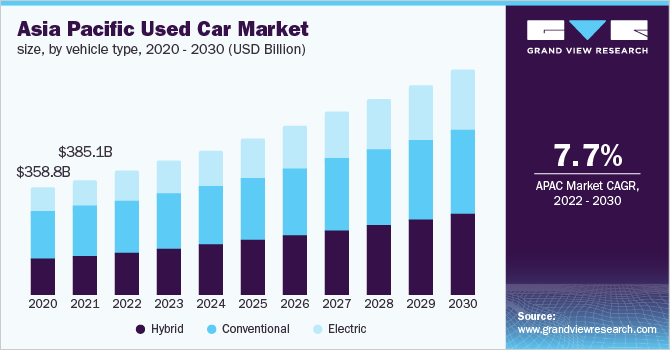

- Asia Pacific

- South America

- MEA (Middle East & Africa)

Market Share Insights:

December 2020: Asbury Automotive Group announced the launch of its end-to-end digital retailing solution called Clicklane to create a great used car online shopping experience.

Key Companies profiled:

Some prominent players in the global Used Car Industry include

- Alibaba

- Asbury Automotive Group

- AutoNation Inc.

- CarMax Business Services, LLC

- Cox Automotive

- eBay Inc.

- Group 1 Automotive Inc.

- Hendrick Automotive Group

- LITHIA Motor Inc.

- Scout24 AG

- TrueCar, Inc.

Order a free sample PDF of the Used Car Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment