Cochlear Implant Industry Overview

The global cochlear implant market size was valued at USD 1.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.71% from 2022 to 2030. The growing prevalence of hearing loss and increase in adoption due to technological advancements are the factors expected to drive the growth of the market. According to World Health Organization (WHO) statistics 2021, approximately 5.0% of the global population (430 million people) undergoes rehabilitation to aid their loss of hearing. Over 2.5 billion individuals are estimated to suffer from some degree of hearing loss by 2050.

Hearing loss has become a major concern in the past few years and can be attributed to various factors including genetic factors, intrauterine infections, birth asphyxia, cerumen impaction, ototoxic medications, and others. These people can benefit from assistive devices including cochlear implants, hearing aids, and others. Favorable reimbursement, the introduction of minimally invasive procedures, and technological advancements are boosting the adoption of cochlear implants.

Gather more insights about the market drivers, restraints, and growth of the Global Cochlear Implant market

Moreover, the rising geriatric population is expected to propel the growth of the cochlear implants market. According to World Health Organization (WHO), the population aged 60 years and above is accounted for above 1.0 billion in 2020 and is estimated to reach 1.4 billion by 2050. As hearing ability decreases with the age, an increase in the age population is expected to bode well with the market.

The onset of COVID-19 imposed restrictions on audiology surgery and treatment services. While drilling in the mastoid cavity, the probability of aerosolizing the virus posed a greater risk of contamination during neurotological (subcategory of ENT) surgeries. This led to the screening of patients for COVID-19 prior to surgery, which delayed the surgical treatments.

Additionally, the children with cochlear implants require Auditory-Verbal Therapy (AVT) at least during the initial 2 years of the implantation, to better understand the auditory information and to learn speech-language skills. Moreover, appointments for the rehabilitation process after surgery were also postponed or delayed. However, surgeries resumed gradually at a different pace in accordance with the relaxations on COVID-19 restrictions in different countries. With the help of telemedicine, audiology surgeries and treatment methods are recovering gradually from the adverse impact of COVID-19.

In the current scenario, the market is slowly recovering with the rise in investment and with the help of telemedicine. For instance, in April 2020, Cochlear Ltd. received FDA approval for Remote Check Solution in the U.S. It is a telehealth patient assessment tool for patients with cochlear implants having Nucleus 7 Sound Processor. They can conduct a series of hearing assessments with the aid of the Nucleus Smart App.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Over-The-Counter Hearing Aids Market - The global over-the-counter hearing aids market size was valued at USD 1.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030.

Hearing Aids Market - The global hearing aids market size was valued at USD 10.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2022 to 2030.

Cochlear Implant Market Segmentation

Grand View Research has segmented the global cochlear implant market based on the type of fitting, age group, end use and region:

Cochlear Implant Type of Fitting Outlook (Revenue, USD Million, 2016 - 2030)

- Unilateral

- Bilateral

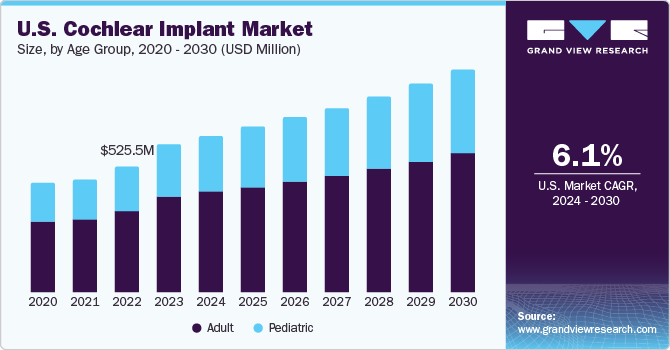

Cochlear Implant Age Group Outlook (Revenue, USD Million, 2016 - 2028)

- Adult

- Pediatric

Cochlear Implant End-use Outlook (Revenue, USD Million, 2016 - 2028)

- Hospitals

- Clinics

- Others

Cochlear Implant Regional Outlook (Revenue, USD Million, 2016 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Market Share Insights

March 2022: So nova Holding AG acquired the consumer division of Sennheiser electronic GmbH & Co. KG which forms the 4th business unit of So nova. This new consumer hearing division is expected to attract growth opportunities from a fast-growing market of audiophile headphones.

Key Companies profiled:

Some of the prominent players in the global cochlear implant market include:

- Cochlear Ltd.

- So nova

- MED-EL Medical Electronics

- Demant A/S

- Zhejiang Nurotron Biotechnology Co., Ltd.

- Oticon Medical

- GAES

Order a free sample PDF of the Cochlear Implant Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment