Productivity Management Software Industry Overview

The global productivity management system market size was valued at USD 47.33 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.8% from 2022 to 2030.The growing requirement to manage tasks and workflow among the business to amplify the growth and swiftly growing advancements in Machine Learning (ML) and Artificial Intelligence (AI) are the key factors driving the market. Furthermore, the growing adoption of cloud computing in the business processes and the increasing adoption of enterprise mobility, smartphones, and Bring Your Own Device (BYOD) to expand the mobile workforce will surge the demand for productivity management software, contributing to the growth of the market.

Organizations have been looking for new ways to boost productivity. New approaches and technology have helped deliver products and services more efficiently and effectively than in the past few years. Productivity growth is critical for companies because delivering more products and services to customers results in high income. When productivity rises, an organization's capital can be converted into sales, allowing it to compensate stakeholders while still preserving cash flow for potential development and expansion.

Gather more insights about the market drivers, restraints, and growth of the Global Productivity Management Software Market

Higher productivity also assists in gaining a competitive advantage over the competitors. Companies are keener to reduce their operational expenses to gain hefty profits, and improved productivity helps them achieve their profitability goals. Organizations are currently looking towards investing in technology-oriented solutions such as productivity management software (PMS) that would offer them centralized productivity management solutions to improve the working environment and reduce costs.

Operational efficiency is mainly a metric that assesses a company's profitability as a function of its operating costs. The more profitable a company or investment is, the more efficient its operations are. The comparison of productivity and operational efficiencies can also provide a look at the economies of scale. Entities strive to achieve productive economies of scale to lower per-unit costs and boost per-unit returns. Executives are concerned with increasing performance, which is a focus of many technology initiatives and implementations.

Efficiency, small business sales, internal processes, procurement, pricing, and business principles are considered transparent business practices. Increased transparency in the business also helps improve the overall operational efficiency of the organizations for which the employees' productivity is a key parameter. Adopting technology-based solutions could help organizations overcome problems associated with operational efficiency and transparency, thus offering greater returns in terms of revenues. Hence, these factors could assist the growth of the market in the forthcoming years.

The COVID-19 pandemic impacted the workflow and team communication in businesses of different sizes. Increasing acceptance of work from home policies by organizations worldwide and the necessity to manage workforces remotely has augmented the requirement for remote work management. Due to remote work management, the need for digitization has grown enormously. PMS has been critical in permitting businesses and workers to achieve workflow continuity. Collaboration software from Zoom, Slack, Cisco Webex, and Microsoft Teams collaboration technology have proved to be particularly helpful for businesses to improve productivity and maintain workflow.

Browse through Grand View Research's IT Services & Applications Industry Related Reports

Business Process Management Market - The global business process management market was valued at USD 12.18 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.8% from 2022 to 2030.

Data Center Accelerator Market - The global data center accelerator market size was valued at USD 10.78 billion in 2021 and is expected to expand at a CAGR of 23.5% from 2022 to 2030.

Productivity Management Software Industry Segmentation

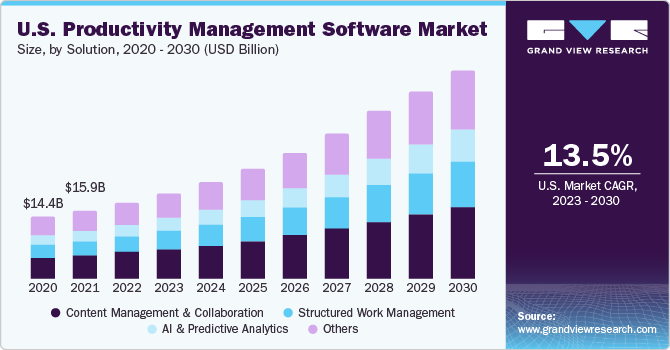

Grand View Research has segmented the global productivity management software market based on solution, deployment, enterprise, and region:

Productivity Management Software Solution Outlook (Revenue, USD Billion, 2018 - 2030)

- Content Management & Collaboration

- AI & Predictive Analytics

- Structured Work Management

- Other Solutions

Productivity Management Software Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On-Premise

- Cloud

Productivity Management Software Enterprise Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Mid-Size Enterprises

Productivity Management Software Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

June 2020, Slack Technologies, Inc. announced a strategic partnership with Amazon Web Services to build deep integrations between Amazon AppFlow and AWS Chatbot. AWS will implement Slack organization-wide to streamline team communication.

Key Companies profiled:

Some prominent players in the global Productivity Management Software Industry include

- Google LLC

- Microsoft

- Salesforce.com, Inc.

- Slack Technologies, Inc.

- Monday.com

- IBM Corporation

- Oracle

- Zoho Corporation Pvt. Ltd.

- Adobe

- HyperOffice

Order a free sample PDF of the Productivity Management Software Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment