Electric Powertrain Industry Overview

The global electric powertrain market size was valued at USD 86.71 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 36.7% from 2022 to 2030. The COVID-19 pandemic affected the overall automotive sector, with a subsequent decline in the growth of the market for electric powertrains due to low automotive sales and new requirements. However, stringent emission norms by government agencies, such as emission standards for Greenhouse gas (GHG) emissions by the U.S. Environmental Protection Agency (EPA), BS-VI norms in India, and China VI, are driving the market growth.

In the past decade, the automotive industry primarily comprised of the same internal combustion engine powertrain. However, the industry now is a broad powertrain mix, as it has been shifting toward more efficient and environmentally friendly transportation. The automotive powertrain portfolio is diversified and includes many pure electric and hybrid powertrains. Additionally, the overall powertrain landscape is becoming more dynamic and complex with the emergence of electric powertrains. The post-COVID-19 recovery in the sales of pure and hybrid electric vehicles is a prominent driving factor for the electric powertrain market. Moreover, the mass adoption of electric cars and attractive incentives by governments for the domestic production of electric vehicles is also anticipated to boost the demand for electric powertrains globally.

Gather more insights about the market drivers, restraints, and growth of the Global Electric Powertrain Market

Electric vehicles are the future of the automotive market, as traditional fuel vehicles are expected to phase out in the coming years. These vehicles are gaining traction as they provide improved environmental benefits and lower total cost of ownership, compared to their internal combustion engine vehicle counterpart. Numerous countries have come up with stringent policies to encourage the adoption of alternative fuel vehicles, including electric vehicles.

Innovations in battery technologies have made EVs more competitive than conventional ICE vehicles by providing increased range in a single charge. Batteries are an integral part of the electric powertrain system. They constitute a significant portion of the total cost of electric cars, and their cost has reduced significantly due to technological advancements, production process optimization, and economies of scale. With the price expected to decline over the forecast period, EVs are expected to reach a Total Cost Ownership (TCO) parity, paving the way for the mass-market penetration of electric vehicles.

The COVID-19 crisis has resulted in a global economic slowdown. Lockdowns implemented in various parts of the world to curb the spread of the virus led to disruptions in the supply chain and a temporary ceasing of production at several production facilities. The electric powertrain market is particularly vulnerable due to its dependency on global sourcing for its batteries' core technology. The initial purchase cost of electric vehicles is more significant than their gas-powered and hybrid counterparts.

The market growth is also being impacted by the growing price sensitivity of customers during the current crisis. Moreover, Europe, which is one of the most prominent regions for the adoption of electric vehicles, is also witnessing a sharp decline in the sales of electric cars. Countries such as Italy, Spain, and Germany are among the worst-hit nations.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Railway Telematics Market - The global railway telematics market size was valued at USD 11.26 billion in 2022 and is estimated to register a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030.

Connected Logistics Market - The global connected logistics market size was valued at USD 29.72 billion in 2022, and is expected to expand at a compound annual growth rate (CAGR) of 14.5% from 2023 to 2030.

Electric Powertrain Industry Segmentation

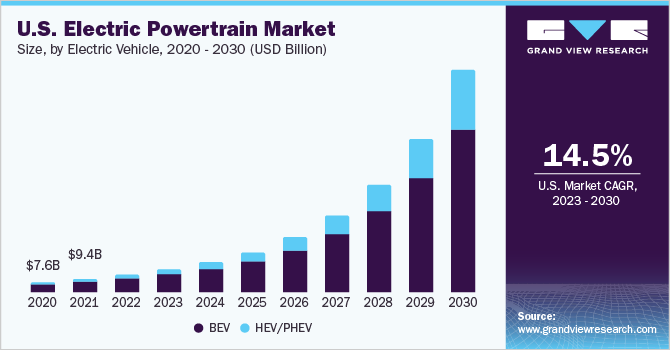

Grand View Research has segmented the global electric powertrain market on the basis of an electric vehicle, component, and region:

Electric Vehicle Outlook (Revenue, USD Billion; Volume, Units, 2018 - 2030)

- BEV

- HEV/PHEV

BEV Electric Powertrain, By Component (Revenue, USD Billion, 2018 - 2030)

- Motor/Generator

- Battery

- Power Electronics Controller

- Converter

- Transmission

- On-Board Charger

HEV/PHEV Electric Powertrain, By Component (Revenue, USD Billion, 2018 - 2030)

- Motor/Generator

- Battery

- Power Electronics Controller

- Converter

- Transmission

- On-Board Charger

Electric Powertrain Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

October 2020: Continental AG’s Powertrain segment Vitesco Technologies announced the launch of a new transmission control system. It is the world’s first transmission control system equipped with over-molding control electronics technology.

August 2020: Magna International Inc. announced to expand its powertrain business in Slovakia, Europe. The company initiated the construction of the manufacturing facility in Slovakia to develop powertrain metal forming solutions.

Key Companies profiled:

Some prominent players in the global Electric Powertrain Industry include

- BorgWarner

- Bosch Limited

- Mitsubishi Electric Corp

- Magna International Inc.

- Schaeffler AG

- ZF Friedrichshafen AG

- Valeo

- Nidec Corporation

- Continental AG

- Magneti Marelli Ck Holdings

Order a free sample PDF of the Electric Powertrain Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment