North America and Australia Silica Industry Overview

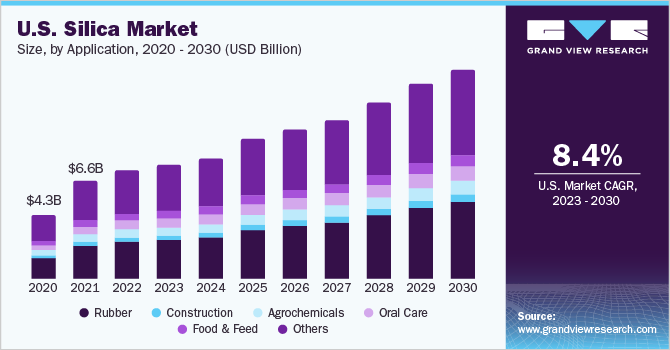

The North America and Australia silica market size was valued at USD 7.18 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 11.0% from 2021 to 2028. Increasing investments in the oil & gas industry coupled with the rising use of foundry sand are propelling the market growth. For instance, in November 2021, Australia approved a USD 12 billion LNG investment where Woodside Petroleum will supply LNG for at least 20 years. Such investments are anticipated to propel market growth as commercial silica is widely used in the oil & gas industry due to its chemical composition, inertness, hardness, purity, and resistance to high temperatures. In 2020, the U.S. was ranked as the world’s leading producer and consumer of industrial sand and gravel.

Its high demand is attributed to the high quality and advanced processing techniques used for its various grades to meet the specifications of different industries. With well-established rubber, glass, foundry, agrochemicals, paints & coatings, oil & gas, and chemical industries in the U.S., the product demand in these applications is in high volumes. However, industrial sand and gravel, especially crystalline silica, continue to face challenges with respect to safety and health regulations and environmental restrictions.

Gather more insights about the revenue drivers, restraints, and growth of the North America And Australia Silica market

The rubber industry is a key consumer of specialty silica and holds significant importance across various end-use industries including defense, automotive, construction, healthcare, agriculture, and others. Specialty silica finds application in the manufacture of tires, industrial rubber, silicone rubber, and footwear. Manufacturers operating in the tire industry are placing their strategic bets on new product launches to stay ahead in the competition. For instance, in December 2021, the Goodyear Tire & Rubber Company launched the new ElectricDrive GT green tires in North America, tuned for Electric Vehicles (EVs). Such developments are anticipated to have a positive influence on the demand for silica in the rubber industry over the forecast period.

Browse through Grand View Research's Advanced Interior Materials Industry Related Reports

Specialty Silica Market - The global specialty silica market size was valued at USD 5.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2022 to 2030.

Aerogel Market - The global aerogel market size was estimated at USD 1.04 billion in 2022 and is expected to register a growth of 16.3% over the forecast period.

North America And Australia Silica Industry Segmentation

Grand View Research has segmented the North America and Australia silica market on the basis of application and region:

North America & Australia Silica Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

- Oil & Gas

- Glass

- Foundry Sand

- Rubber

- Agrochemicals

- Oral Care

- Food

- Desiccants

- Paints & Coatings

- Others

Market Share Insights:

November 2021: Nouryon announced its plans to expand the production capacity for its colloidal silica products at its manufacturing facility in Wisconsin, U.S. Changing consumption habits due to increased marketing activities by major players is further supporting the companies to expand their production capacities.

October 2019: Wacker Chemie AG built a new plant for producing pyrogenic silica at its site in Tennessee, U.S.

Key Companies profiled:

Some prominent players in the North America And Australia Silica Industry include

- Elkem ASA

- Evonik Industries AG

- Nouryon

- PPG Industries, Inc.

- PQ Corp.

- Saint-Gobain

- Solvay

- U.S. Silica

- W. R. Grace & Co.

- Wacker Chemie AG

Order a free sample PDF of the North America And Australia Silica Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment