Orthopedic Devices Industry Overview

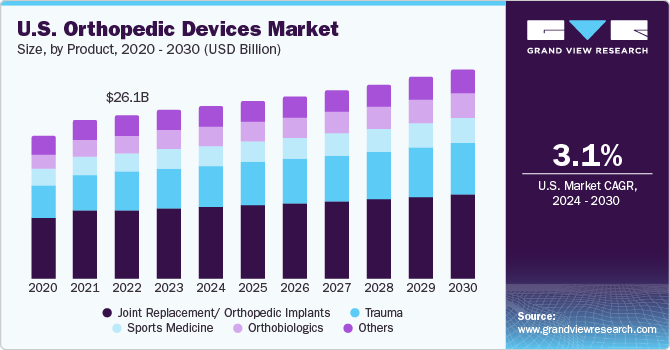

The global orthopedic devices market size was valued at USD 40.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.1% from 2022 to 2030. Market growth can be attributed to the high incidence of orthopedic disorders, such as degenerative bone disease, as well as the growing aging population and the rising number of road accidents. Furthermore, the early onset of musculoskeletal disorders, caused primarily by a sedentary lifestyle and obesity, is projected to fuel market growth. According to data published by the Global Burden of Disease in 2021, musculoskeletal conditions affect about 1.71 billion people in the world. Hence, an increase in musculoskeletal disorders is likely to drive the market from 2022 to 2030.

Currently, available trauma management techniques cannot help restore body parts completely due to the lack of efficient surgical tools. As a result, manufacturers are investing significantly in R&D to develop innovative and efficient devices. This increase in R&D activities is anticipated to ensure high market growth in the near future. An increase in the number of other bone-related disorders and technological advancements are expected to further boost the market. Obesity is one of the primary factors that can cause arthritis. According to studies published in the BMJ Journal in 2020, being overweight or obese increased the risk of knee Osteoarthritis (OA) by 2.5 to 4.6 times compared to being of normal weight.

Gather more insights about the market drivers, restraints, and growth of the Global Orthopedic Devices market

Growing awareness about the availability of innovative products is pushing hospitals to constantly upgrade their devices and services. In addition, reimbursement coverage for orthopedic treatments has fueled the adoption of orthopedic surgeries. These factors allow customers to opt for advanced and higher-priced treatment options, thus, adding to the total revenue generated.

The introduction of advanced orthopedic devices is likely to reduce the price of older ones significantly. This helps increase the adoption of the latter across developing economies in Asia Pacific and the Middle East, where medical reimbursement availability is meager. The cumulative effect of these activities is expected to boost the procedural volume and market growth in the near future.

The COVID-19 pandemic adversely impacted the market due to the cancellation of elective procedures, low demand, and poor sales. Companies also had to face operational challenges due to supply chain disruptions, business closures, travel restrictions, employee illness or quarantines, stay-at-home protocols, and other extended interruptions. In the U.S., for instance, several public health bodies recommended postponing elective surgeries to prevent cross-infection and meet the demand for managing COVID-19 patients.

With the incidence of COVID-19 decreasing, several regulatory bodies released guidelines to help safely resume elective surgeries. These include guidelines prescribed by the American Hospital Association, American College of Surgeons, American Society of Anesthesiologists (ASA), and Association of Perioperative Registered Nurse. Gradual market recovery is anticipated over the coming years, owing to an increase in the target population, resumption of elective surgeries, and a backlog of planned surgeries.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Orthopedic Implants Market - The global orthopedic implants market size was valued at USD 33.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030.

Orthopedic Braces and Supports Market - The global orthopedic braces and supports market size was valued at USD 4.06 billion in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 6.5% from 2022 to 2030.

Orthopedic Device Market Segmentation

Grand View Research has segmented the global orthopedic devices market based on product, application, and region:

Orthopedic Devices Application Outlook (Revenue, USD Million, 2017 - 2030)

- Hip

- Knee

- Spine

- Cranio-Maxillofacial (CMF)

- Dental

- Sports Injuries, Extremities and Trauma (SET)

Orthopedic Devices Product Outlook (Revenue, USD Million, 2017 - 2030)

- Accessories

- Surgical Devices

Orthopedic Devices Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

January 2021: Stryker acquired OrthoSensor, Inc., a private company that specializes in musculoskeletal care.

November 2020: Medtronic PLC launched Adaptix Interbody System a titanium spinal implant.

Key Companies profiled:

Some prominent players in the global orthopedic devices market include:

- Medtronic PLC

- Stryker Corporation

- Zimmer-Biomet Holdings, Inc.

- DePuy Synthes

- Smith and Nephew PLC

- Aesculap Implant Systems, LLC

- Conmed Corporation

- Donjoy, Inc.

- NuVasive, Inc.

Order a free sample PDF of the Orthopedic Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment