Orthopedic Regenerative Surgical Products Industry Overview

The global orthopedic regenerative surgical products market size was valued at USD 4.0 billion in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 3.9% from 2022 to 2030. Growing technological advancements, the prevalence of arthritis and other orthopedic conditions, orthopedic surgeries, and R&D activities are some of the key drivers of this market. In April 2021, the Azienda Ospedaliero-Universitaria Consorziale Policlinico in Italy completed a study on Platelet Rich Plasma (PRP) Injections for knee osteoarthritis in adults aged between 40 and 81 years. This study is one of the many R&D projects registered on the clinicaltrials.gov platform of the U.S. National Library of Medicine.

Orthopedic conditions such as osteoarthritis are the primary cause of disability in the geriatric population and a key driver for the market. According to research published by The Lancet and funded by the National Natural Science Foundation Council of China, the prevalence of knee osteoarthritis across the globe was found to be 16%. The prevalence was found to be higher in individuals aged 40 and above and was estimated to be 22.9% or about 645.1 million people in 2020. The incidence is expected to increase over the forecast period due to sedentary lifestyles, obesity, and an aging population, thus propelling the market for orthopedic regenerative surgical products.

Gather more insights about the market drivers, restraints, and growth of the Global Orthopedic Regenerative Surgical Products Market

The COVID-19 pandemic adversely impacted the market for orthopedic regenerative surgical products due to the cancellation of elective procedures, disruptions in clinical studies, and low demand and sales. Companies also had to face operational challenges due to business closures, supply chain disruptions, travel restrictions, stay-at-home protocols, employee illness or quarantines, and other extended periods of interruption. In the U.S. for instance, several public health bodies recommended postponing elective surgeries to prevent cross-infection and meet the demands of managing coronavirus patients. Patients, too, defer elective surgeries to avoid the risk of exposure to the COVID-19 virus.

Post-COVID and as movement restrictions ease, elective surgeries are expected to increase over time as the underlying causes remain unaffected. Several regulatory bodies have released guidelines to help resume elective surgeries safely. These include guidelines prescribed by the American Society of Anesthesiologists (ASA), American Hospital Association, American College of Surgeons, and Association of Perioperative Registered Nurse. Gradual market recovery is anticipated in 2021 owing to, the resumption of elective surgeries, backlog, and increased target population.

Technological advancements fueled by increasing R&D studies and the use of emerging technologies such as stem cells, viscosupplements, and Platelet Rich Plasma (PRP) therapies are factors anticipated to drive the market for orthopedic regenerative surgical products. According to a 2020 survey published in the International Journal of Complementary and Alternative Medicine, 70% of the respondents viewed regenerative medicine therapies positively in the treatment of musculoskeletal problems. The response was more positive in the case of participants with personal experience of regenerative medicine therapies. PRP- and stem cell-based therapies are at the forefront of regenerative medicine research for indications including repair and restoration of damaged tissues, osteoarthritis, and trauma repair.

In November 2020, Amniox Medical released the results from a retrospective study, wherein amniotic membrane/umbilical cord particulate were found to significantly delay Total Knee Arthroplasty (TKA) in moderate to severe knee osteoarthritis patients. Moreover, there are other innovations such as miniaturized and advanced orthobiologics patches and reservoir-type orthobiologics patches that deliver accurate medication dosage. In addition, the advent of technology supporting targeted organ drug delivery is anticipated to impel the demand for orthobiologics over the forecast period. According to a 2020 survey published in the International Journal of Complementary and Alternative Medicine, 70% of the respondents viewed regenerative medicine therapies positively in the treatment of musculoskeletal problems.

Browse through Grand View Research's Medical Devices Industry Related Reports

Viscosupplementation Market - The global viscosupplementation market size was valued at USD 3.76 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 9.37% from 2021 to 2028.

Joint Replacement Market - The global joint replacement market size was valued at USD 17.1 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.4% from 2021 to 2028.

Orthopedic Regenerative Surgical Products Industry Segmentation

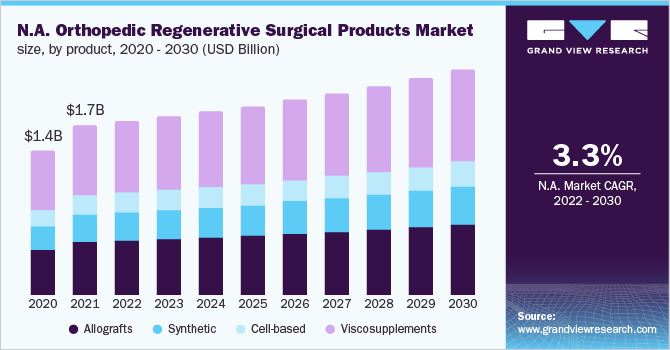

Grand View Research has segmented the global orthopedic regenerative surgical products market based on product, application, end-use, and region:

Orthopedic Regenerative Surgical Product Outlook (Revenue, USD Million, 2017 - 2030)

- Allografts

- Synthetic

- Cell-based

- Viscosupplements

Orthopedic Regenerative Surgical Products Application Outlook (Revenue, USD Million, 2017 - 2030)

- Orthopedic Pain Management

- Trauma Repair

- Cartilage & tendon repair

- Joint reconstruction

- Others

Orthopedic Regenerative Surgical Products End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals

- Ambulatory Surgical Centers

- Others

Orthopedic Regenerative Surgical Products Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

May 2021: MiMedx partnered with the Wake Forest Institute For Regenerative Medicine to conduct research and development for advancements in regenerative science and innovative biologics. This supported the company’s initiative to demonstrate the capability of amniotic tissues to address chronic conditions including musculoskeletal disorders.

Key Companies profiled:

Some prominent players in the global Orthopedic Regenerative Surgical Products Industry include

- Anika Therapeutics, Inc.

- Vericel Corporation

- Baxter

- Zimmer Biomet

- Stryker

- Smith & Nephew

- AlloSource

- Amniox Medical, Inc.

- VSY Biotechnology

- Aptissen S.A.

- MiMedx

- Arthrex, Inc

Order a free sample PDF of the Orthopedic Regenerative Surgical Products Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment