Hard Seltzer Industry Overview

The global hard seltzer market size was valued at USD 8.95 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 22.9% from 2022 to 2030. The rising adoption of low alcohol content beverages among millennials and the younger generation is driving the product demand. Moreover, consumers are trying to reduce their alcohol consumption or becoming ‘sober-curious’, which has further led to an increase in the demand for low-alcoholic beverages. The outbreak of the COVID-19 pandemic has drastically impacted the consumption pattern of alcoholic beverages from high alcohol content to low alcohol content due to the rising health consciousness among the consumers. The sale of hard seltzer during the pandemic rose significantly through e-commerce channels due to stay-at-home orders around the world. Alcohol delivery apps, such as Drizly and Minibar, reported a significant jump in orders during February and March 2020, with the total costs per order more than 20% higher than usual.

According to a survey by IWSR, as of 2019, 52% of consumers surveyed were trying to reduce their alcohol consumption. Moreover, hard seltzer contains low amounts of alcohol, ranging from 1%-8% ABV, and is low-calorie in comparison to beer, with most versions having around 100 calories. Thus, moderate drinkers prefer to consume hard seltzer as a substitute for beer. These properties are anticipated to boost product sales across the globe over the forecast period. Many consumers are looking for reduced sugar, low-calorie, organic, and healthy halo beverages that not only fulfill their demands but also align with their keto and vegan diet. Many manufacturers have been offering products in this category.

Gather more insights about the market drivers, restraints, and growth of the Global Hard Seltzer market

For instance, Mass Bay Brewing Co.’s hard seltzers contain 100 calories and 3 grams of carbohydrates. These are sugar- and gluten-free as well as considered vegan and keto-friendly. In January 2021 Anheuser-Busch InBev launched Michelob Ultra Organic Seltzer in three flavors including spicy pineapple, peach pear, and cucumber lime with zero added sugars. The hard seltzer category has seen immense expansion due to its booming social media presence and pop culture buzz. Brands can be seen grabbing a piece of the social media buzz by creating Instagram-worthy hard seltzer packaging to increase engagement and partnering with influencers and consumers. According to research conducted by Bank of America, there were six times as many conversations about hard seltzer on Instagram in January 2020 as compared to January 2019.

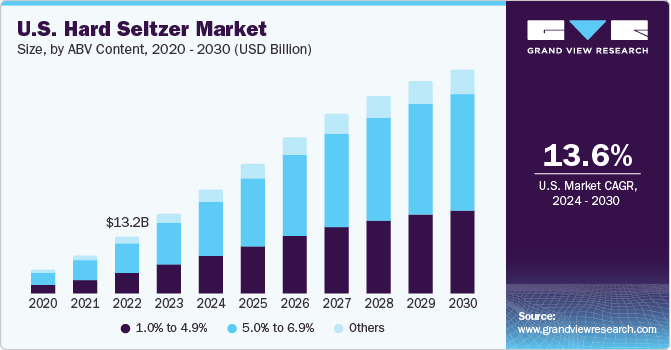

In March 2021 Stewarts Enterprises launched Stewart’s Spiked Seltzer, a line of low-calorie hard seltzers in three flavors, namely Root Beer, Orange Cream, and Black Cherry, to expand in the northeast U.S. Hard seltzer with 5.0% to 6.9% ABV content held the largest revenue share in 2021 and is expected to maintain dominance over the forecast period. The high consumption and wide availability of hard seltzer of this category, especially in the North America region, are driving the growth of this segment. The off-trade segment accounted for a majority of the share in 2021. The increasing availability of such products at Walmart, Target, Costco, and Tesco among others has helped in driving the product sales through off-trade channels.

Browse through Grand View Research's Alcohol & Tobacco Industry Research Reports.

Beer Market - The global beer market size was valued at USD 680.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.0% from 2022 to 2030.

Canned Alcoholic Beverages Market - The global canned alcoholic beverages market size was valued at USD 10.01 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 21.9% from 2022 to 2030.

Hard Seltzer Market Segmentation

Grand View Research has segmented the global hard seltzer market on the basis of ABV content, distribution channel, and region:

Hard Seltzer ABV Content Outlook (Revenue, USD Million, 2017 - 2030)

- 1.0% to 4.9%

- 5.0% to 6.9%

- Others

Hard Seltzer Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Off-trade

- On-trade

Hard Seltzer Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Rest of the World (RoW)

Market Share Insights

April 2021: Mark Anthony Brands, White Claw, launched its first global marketing campaign in collaboration with a diverse group of creators from across the U.S. and around the world to capture unscripted, momentary content inspired by the feeling White Claw evokes.

April 2021: HEINEKEN launched a new hard seltzer brand, Pure Piraña, in Europe and would be available in Austria, Ireland, the Netherlands, Portugal, and Spain.

Key Companies profiled:

Some of the key players operating in the global hard seltzer market include:

- Mark Anthony Brands International

- Anheuser-Busch InBev

- The Coca Cola Company

- Diageo plc

- Heineken N.V.

- The Boston Beer Company

- Molson Coors Beverage Company

- Constellation Brands, Inc.

- Kopparberg

- San Juan Seltzer, Inc.

Order a free sample PDF of the Hard Seltzer Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment