U.S. Frozen Dessert Industry Overview

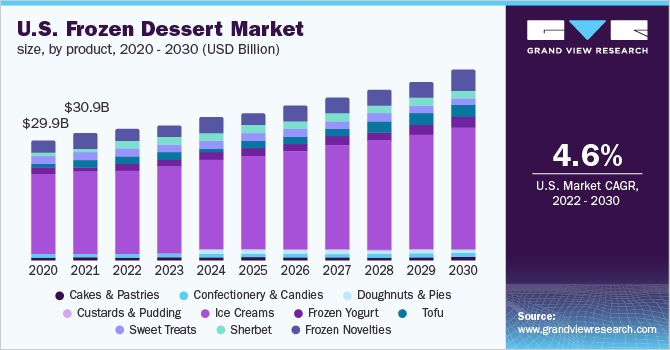

The U.S. frozen dessert market size was valued at USD 30.95 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030. Increasing product launches in the frozen dessert segment such as custard, yogurt, gelato, granita, ice cream, and sherbet would further drive the market. For instance, in September 2021, Sara Lee Frozen Bakery launched a collection of ice creams and novelties in various flavors such as mango, passionfruit, chocolate, and vanilla. The initiative was taken to increase product penetration among consumers preferring varied flavors of ice creams. Increasing health and safety concerns over rising COVID-19 cases obliged people to take fewer trips to stores for buying household items including frozen desserts.

This trend resulted in the need for stockpiling eatables in houses that lasted for a longer duration without spoilage, which further increased the sales of frozen food including desserts in the U.S. For instance, Yasso, a U.S.-based frozen food brand, witnessed a double-digit sales growth during the pandemic in the year 2020. Further, consumers seeking to treat themselves with frozen novelties, such as ice cream, would strengthen the market growth over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the U.S. Frozen Dessert Market

The increasing number of health-conscious consumers seeking out a low-carb and low sugar diet with nutritional benefits will bode well for the market growth. Manufacturers in response to the trend are introducing protein-rich frozen desserts with various health benefits. For instance, in June 2020, Pro Rich Nutrition LLC, a California-based health and dietetic food stores company, introduced Pro Rich dairy-based frozen dessert, fortified with 10-11 grams of protein, 26 vitamins and minerals, amino acids, organic prebiotic fiber, and probiotic cultures and is available in five flavors including JoJo's Original, Rocket Launch, Chocolate Chunk, Mint Madness, and Strawberry Sundae. It is gluten-free, non-GMO, and contains no artificial colors, flavors, sweeteners, or preservatives.

Many key brands and companies in the U.S. are launching innovative limited edition and seasonal flavors for frozen desserts in collaboration with other small brands in the country, which is likely to gain traction among consumers. For instance, in July 2021, Kraft Macaroni & Cheese launched a limited-edition ice cream in collaboration with Brooklyn-based ice cream brand -Van Leeuwen. Both the brands collaborated to launch Kraft Macaroni & Cheese as a summer treat that claims to have no artificial flavors and preservatives. Kraft Macaroni & Cheese ice cream would be available at Van Leeuwen scoop shops and online.

The COVID-19 pandemic has resulted in digitalizing the process of ordering and shipping for frozen dessert brands through their websites and other e-commerce retailers. For instance, in March 2022, GoodPop frozen pops launched a United States Department of Agriculture (USDA) certified organic pops that are 100% fruit juice-based and made with no added sugar. The pops will be available in a pack of six in three flavors: orange, cherry, and grape. These products will be available at GoodPop’s online shop across the U.S. beginning in April. Hence, initiatives like these will propel market growth in the coming years.

Furthermore, various mergers & acquisitions by key players in the market would integrate well with the upward growth trend. For instance, in December 2021, The Urgent Company, a consumer brand subsidiary of Perfect Day, acquired Coolhaus, a frozen ice-cream brand and a pioneer in dessert innovation and novelties. This initiative was taken in response to expanding the company’s product portfolio, providing a better food system to the consumers in Los Angeles, and stronghold its growing range in the dairy aisle. Similarly, in January 2022, MidOcean Partners acquired Casper’s Ice Cream (Casper’s), a manufacturer and supplier of branded and co-packed frozen novelty products sold in grocery and mass retail outlets throughout the U.S.

Browse through Grand View Research's Consumer F&B Industry Related Reports

U.S. Confectionery Market - The U.S. confectionery market size was valued at USD 38.17 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030.

Frozen Bakery Market - The global frozen bakery market was worth USD 42.95 billion in 2022, expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030.

U.S. Frozen Dessert Market Segmentation

Grand View Research has segmented the U.S. frozen dessert market based on product, distribution channel, and state:

U.S. Frozen Dessert Product Outlook (Revenue, USD Billion, 2017 - 2030)

- Cakes & Pastries

- Confectionery & Candies

- Doughnuts & Pies

- Custards & Pudding

- Ice Creams

- Frozen Yogurt

- Tofu

- Sweet Treats

- Sherbet

- Frozen Novelties

U.S. Frozen Dessert Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

- Retail

- Food Service

U.S. Frozen Dessert State Outlook (Revenue, USD Billion, 2017 - 2030)

- California

- Texas

- New York

- Florida

- New Jersey

- Indiana

Market Share Insights:

March 2022: So Delicious Dairy Free introduced a new line of frozen desserts, which are made with the company’s Wondermilk and come in both pints and cones.

January 2022: Mondelez International, Inc. launched a line of frozen desserts, which is sold under the Oreo brand.

Key Companies profiled:

Some prominent players in the U.S. Frozen Dessert market include

- Unilever

- Nestlé

- Froneri International Limited

- Blue Bell Ice Cream

- Wells Enterprises, Inc.

- Winward Brands LLC

- Tofutti Brands, Inc.

- MTY Food Group (Cold Stone Creamery)

- Dairy Farmers of America, Inc.

- Conagra Brands

Order a free sample PDF of the U.S. Frozen Dessert Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment