Vegan Confectionery Industry Overview

The global vegan confectionery market size was valued at USD 1.11 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.8% from 2022 to 2030. The increasing shift among consumers towards plant-based diets, as a result of lifestyle disorders and health concerns, has been fueling the growth of the worldwide market in recent years. Social media posts on the vegan lifestyle and its benefits also encourage consumers to adopt plant-based diets, thereby contributing to market growth.

The unprecedented COVID-19 outbreak caused major supply chain disruptions, forcing brands to focus on leveraging their online presence owing to lockdowns in most countries. Further, the disrupted supply chain impacted the entire food industry worldwide. The small and craft chocolate businesses suffered the most due to shortages in supply, coupled with their inventories being depleted as a result of panic buying by customers.

Gather more insights about the market drivers, restraints, and growth of the Global Vegan Confectionery market

Increasing concerns about animal cruelty, personal health & wellness, and the environment have been popularizing plant-based lifestyles among consumers worldwide. As a result, the plant-based food industry has been expanding over the years and offering a wide range of products. Both small and large food firms are entering the industry to tap the potential offered by the rising demand. In June 2018, Sodexo, a large catering company, partnered with the Humane Society of the United States to create over 200 plant-based food items for campus dining halls and corporate foodservice facilities.

Furthermore, the increased number of new product launches in the vegan confectionery industry has accelerated market growth. As per The Vegan Society, the product launches grew by 185% between 2012 and 2016 in the U.K. The large retail chains, including Walmart, are interested in offering more plant-based food items. In addition, an increased number of lactose-intolerant people has raised the demand for dairy-free confections across the globe. These factors are expected to accelerate the growth of the market in the upcoming years.

There is significant scope for the growth of the global vegan confectionery market, as the concept of veganism is gaining prominence in developed countries such as the U.K., the U.S., Australia, New Zealand, Germany, Italy, France, and Canada. In addition, various Middle Eastern countries such as Israel and Saudi Arabia have been witnessing a growth in the vegan population, which offers several growth opportunities for manufacturers and new entrants.

Many countries in Europe have been severely impacted by the COVID-19 crisis, which has led to a decline in economic activities. Germany, Italy, and France being the most visited countries in Europe, are creating opportunities for vegan candy manufacturers to supply on-the-go vegan candies in form of packaged and ready-to-eat food. With the largest confectionery product consuming population, the region is taking initiatives to improve the quality and standard of food products by the means of vegan ingredients.

Browse through Grand View Research's Consumer F&B Industry Research Reports.

Chocolate Confectionery Market - The global chocolate confectionery market size was valued at USD 178.8 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030.

Sweeteners Market - The global sweeteners market size was valued at USD 79.01 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 2.4% from 2022 to 2030.

Vegan Confectionery Market Segmentation

Grand View Research has segmented the global vegan confectionery market on the basis of product, distribution channel, and region:

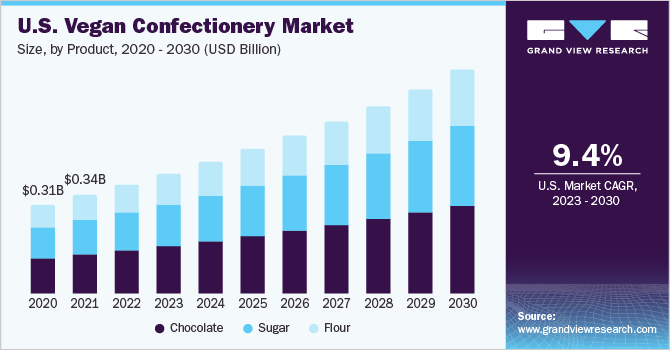

Vegan Confectionery Product Outlook (Revenue, USD Million, 2017 - 2030)

- Chocolate

- Sugar

- Flour

Vegan Confectionery Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Online

- Offline

Vegan Confectionery Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa

Market Share Insights

January 2022: Global Cargill Group confirmed that it has developed a new vegan chocolate, ExtraVeganZa. According to the company, its chocolate engineers identified key plant-based “power” ingredients - sunflower kernel powder, rice syrup, and organic rice syrup

October 2021: Cadbury confirmed their intent to launch its first vegan chocolate bar in response to an “increasing public appetite for plant-based alternatives”. The new dairy-free bar, called Plant Bar, is a vegan version of Cadbury’s Dairy Milk, one of the most popular chocolate bars in the UK. The chocolate bar, which has been approved by The Vegan Society, was confirmed to be available in two flavors, namely, smooth chocolate, and smooth chocolate with salted caramel pieces

Key Companies profiled:

Some of the key players operating in the vegan confectionery market include:

- Taza Chocolate

- Alter Eco

- Endangered Species Chocolate, LLC,

- EQUAL EXCHANGE COOP

- Chocoladefabriken Lindt & Sprüngli AG

- Mondelēz International

- Dylan's Candy Bar

- Endorfin

- Goodio

- Freedom Confectionery

- Creative Natural Products, Inc.

Order a free sample PDF of the Vegan Confectionery Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment