Veterinary Telehealth Industry Overview

The global veterinary telehealth market size was valued at USD 119.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 17.6% from 2022 to 2030. The growing adoption of these management systems can be attributed to the steady growth in the focus on veterinary telehealth along with disease detection. Furthermore, the prevalence of zoonotic and chronic diseases in animals and the rising adoption of IoT & AI by pet parents are some of the major drivers for the market. The increasing prevalence of diseases such as diabetes, kidney diseases, spinal disc problems, and blood pressure-related issues is further fueling the market.

The increasing incidence of obesity in pets due to conditions such as joint diseases & osteoarthritis is fueling the demand for better treatment options. Further, disease outbreaks in the livestock can be major socioeconomic threats, resulting in disruption of local markets, international trade, and rural markets as well as production loss. Such factors are driving the market for veterinary. The COVID-19 pandemic is confidently influencing the market for veterinary telehealth. The interest in veterinary telehealth is increasing during the ongoing crisis. According to a 2020 article published by the Veterinary Medical Association, the use of telemedicine has grown to monitor and protect the health of veterinary teams and veterinary patients.

Gather more insights about the market drivers, restraints, and growth of the Global Veterinary Telehealth Market

For instance, in March 2021, a leading integrated healthcare company in India, Practo, announced the launch of a veterinary telemedicine service. Likewise, in May 2020, TeleTails launched a new software solution in response to the COVID-19 pandemic, called TeleTails Instant which is a video conferencing tool. However, government restrictions on veterinary telemedicine are expected to limit how liberally veterinary professionals use telemedicine. This is due to the increased availability of COVID-19 vaccines provides individuals more latitude to take their animals to practitioners in person. For instance, The U.K. has proclaimed in November 2021 that they ended waivers of their telemedicine restrictions. Thus, limiting the adoptions to some extent. However, increasing awareness and associated benefits with the use of telehealth platforms are supporting the growth.

The increasing prevalence of zoonotic diseases and chronic animal diseases is also contributing to the telehealth market. According to WHO statistics, in 2021, it was estimated that millions of deaths and about 1 million cases of illness occur each year from zoonotic diseases and around 60% of emerging infections worldwide are the result of zoonotic diseases. Thus, the increase in infections is compelling pet owners and farm animal owners to adopt telehealth services for improving and monitoring the health of their pets and animals. The upsurge in animal healthcare spending is anticipated to boost the market growth. According to the 2021 report by APPA - American Pet Products Association, the cumulative spending in the U.S. pet industry has increased by 1.06% from 2019 to 2020.

Moreover, the rising concern of owners about their animals has resulted in an increase in pet care expenditure which is further fueling the growth.Furthermore, in 2021, approximately 1,09,600miilions was spent on pets and 1,03,600millions in 2020 in U.S.The increasing demand for animal healthcare is propelling the market growth. Furthermore, there is high demand and an increasing rate of consumption for animal-derived products is anticipated to drive the market for veterinary telehealth. This growing demand is eventually increasing the need to protect animals from diseases. According to the International Service for the Acquisition of Agri-biotech Applications (ISAAA), the demand for meat and milk production is anticipated to double by 2050 in developing countries. Such factors are propelling the adoption of telehealth for animal healthcare.

Browse through Grand View Research's Animal Health Industry Related Reports

Veterinary MRI Market - The global veterinary MRI market size was valued at USD 205.93 million in 2022 and is expected to expand at a lucrative compound annual growth rate (CAGR) of 7.38% from 2023 to 2030.

Veterinary CT Imaging Market - The global veterinary CT imaging market size was estimated at USD 373.03 million in 2022 and is expected to expand at a lucrative compound annual growth rate (CAGR) of 7.03% from 2023 to 2030.

Veterinary Telehealth Market Segmentation

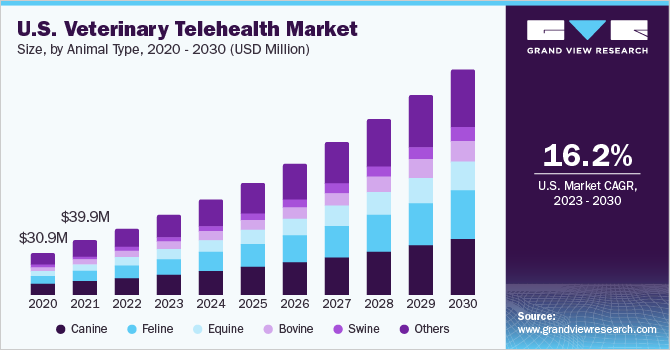

Grand View Research has segmented the global veterinary telehealth market on the basis of animal type, service type, and region:

Veterinary Telehealth Animal Type Outlook (Revenue, USD Million, 2017 - 2030)

- Canine

- Feline

- Equine

- Bovine

- Swine

- Others

Veterinary Telehealth Service Type Outlook (Revenue, USD Million, 2017 - 2030)

- Telemedicine

- Teleconsulting

- Telemonitoring

- Others

Veterinary Telehealth Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

August 2020: Televet partnered with Cornell University Hospital for Animals. With this, the company would deploy its telehealth platform for the University’s veterinary telehealth operations. This extended the company’s market growth.

July 2020: Zoetis partnered with telemedicine companies such as Vet-AI and Video With My Vet.

Key Companies profiled:

Some prominent players in the global Veterinary Telehealth market include

- Airvet

- Activ4Pets

- BabelBark, Inc.

- GuardianVets

- PetDesk

- Petzam

- TeleTails

- Televet

- Vetster, Inc.

- VitusVet

- Whiskers Worldwide, LLC

- Virtuwoof, LLC

- FirstVet

- PawSquad

- Petriage Inc.

Order a free sample PDF of the Veterinary Telehealth Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment