Neobanking Industry Overview

The global neobanking market size was valued at USD 66.82 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 54.8% from 2023 to 2030. The rising demand for convenience among customers in the banking sector is expected to drive market growth. Neobanks offer banking solutions without the need for physical branches or offices. They help users validate their service offerings in real-time through online channels and mobile sites. In addition, the growing adoption of smartphones and the internet across the world for online banking is expected to further accelerate the demand for neobank platforms.

The increasing number of partnerships of banks and organizations to launch neobanks platforms is also accelerating the market growth. Such partnerships are aimed toward providing a better customer experience and enhanced safety and stability. For instance, in April 2021, Google pay co-creators announced the launch of Fi, a neobank, in partnership with the Federal Bank to provide an instant savings account with debit cards for salaried millennials. Technological advancements and the notable increase in internet penetration globally allow financial service providers to offer novel digital services to customers. Moreover, the growth in digital wallets has also been driving the demand for online banking platforms.

Gather more insights about the market drivers, restraints and growth of the Global Neobanking Market

According to Visa, a multinational financial service company, there are more than one billion mobile money wallets worldwide. Many financial service providers are collaborating with mobile money wallet providers to offer affordable money transfer services. Neobanking is gaining popularity among retail customers and Small- and Medium-sized Enterprises (SMEs). Free debit cards, digitized account opening, personal finance advisory, instant payments, e-bill generation, invoice management, account integration, and GST-compliant invoicing are some of the key features propelling retail customers and SMEs to adopt neobanks over traditional banks and use the digital services offered by them efficiently.

Furthermore, the neobanking model also offers a low-cost structure, easy accessibility, and advanced services. Its cost efficiency is primarily driven by the low real estate & distribution costs, less complex IT systems, and streamlined operating models. Venture capitalists and equity investors are focusing on the market opportunities and investing in neobanks. For instance, according to the MEDICI India Fintech report 2020, India’s neobank startups raised more than USD 200 million in 2020. However, neobanks offer a limited range of product offerings compared to traditional banks, which is expected to hinder market growth. Profitability is another issue faced by neobanks as they offer services at a reduced cost to attract new customers.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Retail Core Banking Solution Market - The global retail core banking solution market size was valued at USD 4.07 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.8% from 2022 to 2030.

Open Banking Market - The global open banking market size was valued at USD 20.07 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 27.2% from 2023 to 2030.

Neobanking Market Segmentation

Grand View Research has segmented the global neobanking market on the basis of account type, application, and region:

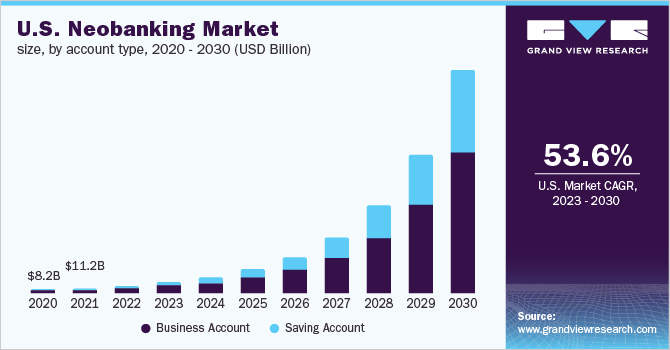

Neobanking Account Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Business Account

- Savings Account

Neobanking Application Outlook (Revenue, USD Billion, 2017 - 2030)

- Enterprises

- Personal

- Others

Neobanking Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

December 2021: Open, an SME Neobanking platform provider, announced the acquisition of Finin, a consumer Neobanking platform, for USD 10 million in cash and stock deal.

November 2021: Fedo, a health tech company, announced the launch of a health savings account named Fedo HSA in partnership with Open, a neobank. Through this partnership, Fedo HSA planned to offer combined accounts that help customers meet their required spendings through a combination of insurance, smart savings, and line of credit bundled in savings accounts with health credit and debit card features.

Key Companies profiled:

Some prominent players in the global Neobanking market include

- Atom Bank PLC

- Fidor Bank Ag

- Monzo Bank Ltd.

- Movencorp Inc.

- Mybank

- N26

- Revolut Ltd.

- Simple Finance Technology Corp.

- Ubank Limited

- Webank, Inc.

Order a free sample PDF of the Neobanking Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment