U.S. Veterinary Oncology Industry Overview

The U.S. veterinary oncology market size was valued at USD 81.66 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2030. The major contributors to the market growth are the increasing prevalence of cancer cases, the growing number of pet owners, technological advancements in per cancer therapeutics, and ongoing clinical trials related to veterinary oncology. Moreover, pet owners are willing to spend more on pet health, which is also among the major factors driving the demand for pet cancer therapies. The COVID-19 pandemic has changed pet owners’ relationships with their companions. It acted as a catalyst for rapid business and economic changes.

As various governments across the world urged individuals to stay at home during the pandemic, many people found comfort and companionship through pets. The pet expenditure has witnessed an increase during the coronavirus breakdown. At the animal shelters in the country, adoption rates soared as much as 40% in 2020 as compared to 2019. Growing R&D in veterinary oncology to provide the best treatments to pets with cancer is a major boon for the market. An increase in investments related to pet cancer therapeutics by organizations is expected to fuel the market growth. The corporations are engaging in strategies, such as licensing, R&D collaborations, and business development, to enhance their product pipeline in veterinary oncology.

Gather more insights about the market drivers, restraints and growth of the U.S. Veterinary Oncology Market

For instance, in 2020, Boehringer Ingelheim spent USD 412 million on their R&D activities. Furthermore, ongoing clinical trials in this field support the market growth. In March 2020, The University of Illinois Cancer Care Clinic and Comparative Oncology Research Laboratory publicized two clinical trials for canine cancer. Other supportive drugs are still in pipeline and are expected to offer lucrative opportunities in the coming years. Veterinary medicine has evolved numerously in recent years and advancements in technology permit to provide medical attention to pets as it is available for humans.

Technological upgradation in the veterinary sector to provide an effective treatment to companion animals drives the market growth. In addition, the presence of major players in the country further contributes to its growth. Participants in the country are actively involved in product expansion strategies to gain a competitive advantage. For instance, in January 2021, CureLab Oncology started CureLab Veterinary, a subsidiary with exclusive rights to use CureLab Oncology patents for the treatment of canines, felines, and horses worldwide. The first target market for the subsidiary’s patented DNA therapeutics is canines and felines. The company also has seven R&D sites in the U.S.

Browse through Grand View Research's Animal Health Industry Related Reports

Veterinary MRI Market - The global veterinary MRI market size was valued at USD 205.93 million in 2022 and is expected to expand at a lucrative compound annual growth rate (CAGR) of 7.38% from 2023 to 2030.

Veterinary Medicine Market - The global veterinary medicine market size was estimated at USD 44.59 billion in 2022 and is expected to expand at a lucrative compound annual growth rate (CAGR) of 8.2% over the forecast period.

U.S. Veterinary Oncology Market Segmentation

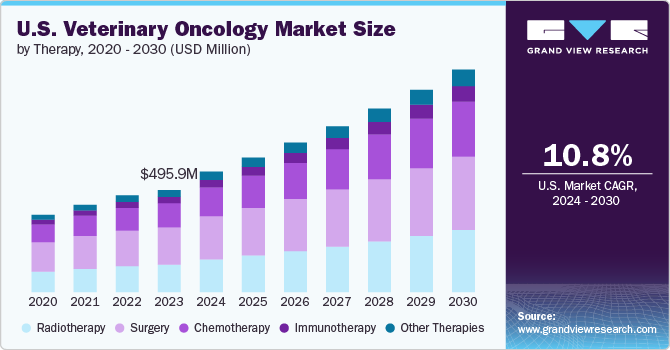

Grand View Research has segmented the U.S. veterinary oncology market on the basis of therapy and animal type:

U.S. Veterinary Oncology Therapy Outlook (Revenue, USD Million, 2017 - 2030)

- Surgery

- Radiology

- Chemotherapy

- Immunotherapy

- Others

U.S. Veterinary Oncology Animal Type Outlook (Revenue, USD Million, 2017 - 2030)

- Canine

- Feline

- Others

Market Share Insights:

January 2021: The U.S. FDA conditionally approved verdinexor tablets by Karyopharm Therapeutics Inc. to treat lymphoma in canines. This is the first oral treatment to treat dogs with lymphoma.

May 2020: PetCure Oncology and Sugar Land Veterinary Specialists publicized a novel radiation oncology service, expanding their network in Houston.

Key Companies profiled:

Some prominent players in the U.S. Veterinary Oncology market include

- Boehringer Ingelheim International GmbH

- Elanco

- Zoetis

- PetCure Oncology

- Accuray Inc.

- Varian Medical System, Inc.

- Morphogenesis, Inc.

- Karyopharm Therapeutics, Inc.

- Regeneus Ltd.

- One Health

Order a free sample PDF of the U.S. Veterinary Oncology Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment