Music Streaming Industry Overview

The global music streaming market size was valued at USD 29.45 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 14.7% from 2022 to 2030. The rising penetration of digital platforms and the growing use of smart devices are anticipated to boost the market growth over the forecast period. Platforms that allow users to listen to audio and podcasts and watch music videos are examples of music streaming services. These platforms are gaining popularity owing to features such as song recommendations, automatic playlist personalization, and hassle-free connectivity on apps and browsers. Moreover, the expanding podcast genres on these portals are propelling the market growth.

In 2020, the COVID-19 outbreak prompted most countries to impose lockdowns in order to prevent the virus from spreading. This led to an increasing number of subscribers on music streaming platforms, such as Spotify, Tencent Music Entertainment, and Amazon Music. Moreover, the number of subscribers that engage in live streaming on platforms such as Instagram and YouTube witnessed a surge. In the U.S., video content was already streamed more frequently than audio content. However, it gained significant popularity during the pandemic. As a result, COVID-19 has had a significant impact on the expansion of the market for music streaming.

Gather more insights about the market drivers, restraints, and growth of the Global Music Streaming Market

The rising use of 5G connectivity has become one of the most popular trends in the global market. Amazon has capitalized on this opportunity by launching a new music HD service that will provide lossless music streams and downloads to music enthusiasts in the U.S., the U.K., Germany, and Japan. With 5G's capability to send data several times faster than 4G, companies will be able to offer high-fidelity music streams as the technology is more widely adopted. For live streaming music videos, Virtual Reality (VR), Augmented Reality (AR), and hologram concerts are expected to gain wide popularity. Such developments are fueling the growth of the market.

Music streaming suppliers are focused on offering podcasts, song lyrics, and music videos on their platforms to improve customer experience. For instance, in November 2021, Spotify AB partnered with Netflix, Inc., an American subscription streaming service and production company, to offer Spotify users exclusive soundtracks, playlists, and content on the music streaming platform. Additionally, in May 2019, SoundCloud Limited acquired Report Network, which operates as a SoundCloud focused music distributor, to provide innovative creators with a fully integrated upstream to Repost Network's invite-only tools and services, which comprise content protection, analytics dashboards, streaming distribution, and more.

Furthermore, new licensing prospects are starting to emerge for music IP holders. Short videos, e-fitness, and other platforms are focused on acquiring IP rights from music creators and publishers, potentially opening new revenue streams. For instance, in July 2020, the National Music Publishers Association (NMPA) secured a licensing agreement with TikTok, a platform with around 100 million U.S. monthly active users and 700 million worldwide monthly active users. Nowadays, the music industry is heavily regulated with a strong focus on the publishing rights of the music. Moreover, various regulatory amendments have been made to recognize the rights of music creators in the digital age. While such reforms are hampering the revenues of music streaming companies, they are likely to benefit from recurring incomes for the content consumed.

Browse through Grand View Research's Communication Services Industry Related Reports

Broadcasting & Cable TV Market - The global broadcasting & cable TV market size was valued at USD 332.59 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030.

In-flight Entertainment And Connectivity Market - The global in-flight entertainment and connectivity market was valued at USD 5.96 billion in 2022 and is anticipated to witness a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030.

Music Streaming Market Segmentation

Grand View Research has segmented the global music streaming market based on service, platform, content type, end-use, and region:

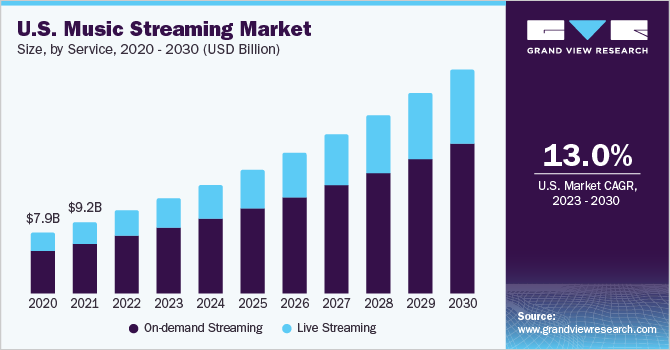

Music Streaming Service Outlook (Revenue, USD Billion, 2018 - 2030)

- On-demand Streaming

- Live Streaming

Music Streaming Platform Outlook (Revenue, USD Billion, 2018 - 2030)

- Apps

- Browsers

Music Streaming Content Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Audio

- Video

Music Streaming End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Individual

- Commercial

Music Streaming Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

December 2021: Spotify AB partnered with Tinder, Inc., an online dating and geosocial networking application, to improve the mood of music for singles during Christmas. Moreover, companies have introduced the Music Mode feature, Tinder’s biggest update since the Swipe feature. Music Mode allows users to embed their favorite tunes in their dating profiles.

April 2020: Apple, Inc. introduced its music streaming service in 52 new countries to expand Apple Music's global reach.

Key Companies profiled:

Some prominent players in the global Music Streaming market include

- Spotify AB

- Apple, Inc.

- Amazon, Inc.

- Google LLC

- Deezer

- Pandora Media, Inc.

- Tencent Music Entertainment Group

- Tidal

Order a free sample PDF of the Music Streaming Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment