Peptide Therapeutics Industry Overview

The global peptide therapeutics market size was valued at USD 39.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. The rising incidence of cancer as well as metabolic disorders such as osteoporosis, obesity, and diabetes will drive the adoption of peptide therapeutics during the forecast period. Due to the sheer growing number of affected pediatric patients and the pervasiveness of target diseases in low-income countries, there is a high demand for efficient and low-cost drugs.

Advanced peptides are now being created and reconfigured as therapeutics for COVID-19. Researchers around the world are looking for compounds that either block the mechanisms involved in Severe acute respiratory infection and replication or treat the conditions resulting from infection. The Food and drug administration updated its description of a biologic on February 21, 2020, to include chemically synthesized polypeptides with more than 40 amino acids but much less than 100 amino acids in size and synthetic peptides with 40 amino acids or even less. As a result, because peptide drugs are being recognized as a potential treatment for COVID-19, COVID-19 may have a positive effect on the market.

Gather more insights about the market drivers, restraints, and growth of the Global Peptide Therapeutics market

The market is estimated to witness lucrative growth in the forecast period due to the initiatives undertaken by many companies for investigating the development of new drug candidates. To retain their position in the market, companies engage in extensive R&D initiatives to develop novel drugs exhibiting higher efficiency in the treatment of target diseases. Clinical trials for these drugs have also significantly increased over the past decade. This is also expected to propel growth over the forecast period. For instance, in January 2022, Amgen and Generate Biomedicines declared a research partnership deal to explore and develop protein therapeutics for its five clinical objectives throughout multiple therapeutic areas and modes of delivery.

Moreover, chronic diseases like cancer and diabetes and cardiovascular diseases are the foremost causes of morbidity and mortality worldwide, as per the World Health Organization (WHO). Chronic disease rates have skyrocketed globally, advancing across all regions and affecting all socioeconomic classes. Chronic diseases were estimated to cause 73 percent of all deaths and 60 percent of the global disease burden in 2020. As a result, the rising prevalence of chronic diseases increases the demand for effective therapeutics, which is anticipated to drive the market. However, peptide therapeutics' upheaval, the rising cost of developing drugs, and strict regulatory prerequisites for drug approval are expected to limit the market growth.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

Gastrointestinal Therapeutics Market - The global gastrointestinal therapeutics market size was valued at USD 37.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.3% from 2023 to 2030.

Head And Neck Cancer Therapeutics Market - The global head and neck cancer therapeutics market size was valued at USD 1.22 billion in 2021 and is expected to expand at a compounded annual growth rate (CAGR) of 12.5% from 2022 to 2030.

Peptide Therapeutics Market Segmentation

Grand View Research has segmented the global peptide therapeutics market by application, type, type of manufacturers, route of administration, synthesis technology, and region:

Peptide Therapeutics Application Outlook (Revenue, USD Million, 2017 - 2030)

- Cancer

- Metabolic

- Cardiovascular Disorder

- Respiratory

- GIT

- Antiinfection

- Pain

- Dermatology

- CNS

- Renal

- Others

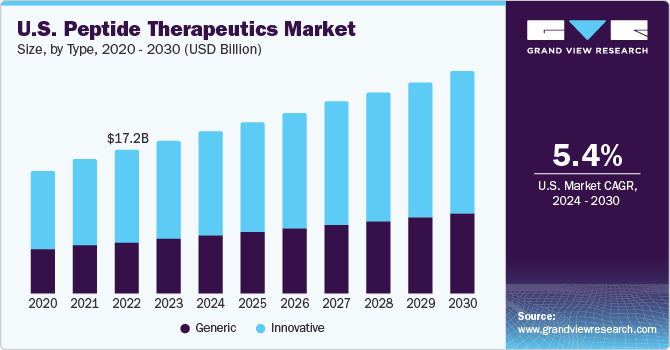

Peptide Therapeutics Type Outlook (Revenue, USD Million, 2017 - 2030)

- Generic

- Innovative

Peptide Therapeutics Type of Manufacturers Outlook (Revenue, USD Million, 2017 - 2030)

- In-house

- Outsourced

Peptide Therapeutics Route of Administration Outlook (Revenue, USD Million, 2017 - 2030)

- Parenteral Route

- Oral Route

- Pulmonary

- Mucosal

- Others

Peptide Therapeutics Synthesis Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Solid Phase Peptide Synthesis (SPPS)

- Liquid Phase Peptide Synthesis (LPPS)

- Hybrid Technology

Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

May 2022: Pfizer Inc. and Biohaven Pharmaceutical Holding Company Ltd. revealed a new agreement under which Pfizer will procure Biohaven, the manufacturer of NURTEC ODT, an advanced dual-acting migraine therapy authorized for both acute treatments as well as episodic migraine prevention in adults.

May 2022: Bristol Myers Squibb and LOTTE Corporation stated that LOTTE has decided to acquire Bristol Myers Squibb's East Syracuse, New York-based production plant. The East Syracuse location will house LOTTE's novel biologics CDMO business in the U.S.

Key Companies profiled:

Some of the prominent players in the Peptide Therapeutics market include:

- Eli Lilly and Company

- Pfizer, Inc.

- Amgen, Inc.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceuticals Industries Ltd.

- Lonza Inc.

- Sanofi

- Bristol-Myers Squibb (BMS)

- AstraZeneca PLC

- GlaxoSmithKline plc (GSK)

- Novartis AG

- Novo Nordisk A/S

Order a free sample PDF of the Peptide Therapeutics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment