Hearing Aids Industry Overview

The global hearing aids market size was valued at USD 10.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2022 to 2030. The market growth can be attributed to key factors such as the increasing adoption of hearing aids devices, growing awareness regarding technologically advanced devices for the treatment of deafness and hearing impairment, and the increasing prevalence of hearing loss due to the growing geriatric population. The market is a highly technological driven market that has seen the emergence of novel products including smart linked hearing aids, invisible hearing aids, and AI- and Bluetooth-enabled hearing aids that can be connected to Android or iOS.

For example, in August 2021, Phonak introduced the world's first waterproof rechargeable, Audéo Life hearing aid. Hence, hearing aid companies are improving patients' experiences with new features and technology, which is expected to fuel market growth in the coming years. Moreover, in the U.S., approximately 15% of patients aged between 18 and over suffer from hearing loss. For instance, the FDA announced a proposal in October 2021 that it wants to establish a new category of low-cost over-the-counter hearing aids. This opens up a new revenue stream for businesses looking to acquire a foothold in the OTC hearing aid market.Such substantial government and regulatory support are projected to have a long-term positive impact on the hearing aids sector in the U.S.

Gather more insights about the market drivers, restraints and growth of the Global Hearing Aids market

Moreover, hearing service offices and general healthcare service associations of local governments in both developed and developing economies are emphasizing early screening of deafness and the provision of hearing aids to people. As the healthcare sector in emerging economies is moving towards privatization, healthcare infrastructure in these countries is undergoing rapid development. Education and increased awareness regarding health among people are also playing an important role in increasing the demand for these devices and their diagnostic services.

The COVID-19 outbreak has had a significant impact on the healthcare industry. Among COVID-19 positive patients, most hospitals are running out of beds. In addition, a number of elective procedures are being canceled or postponed in order to reallocate resources. According to the Hearing Industries Association (HIA), hearing aid sales in the U.S. has declined by 29.7% in the first half of 2020. Due to the postponement of procedures like the cochlear implantation technique, which is one of the most significant treatments to address hearing impairments, the pandemic had a detrimental influence on the total sales of hearing aid support goods. As a result, sales of hearing aids from major manufacturers have decreased.Despite all of these obstacles, the hearing aids business and other medical industries are progressively regaining ground as the COVID-19 situation throughout the world normalizes.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Over-The-Counter Hearing Aids Market - The global over-the-counter hearing aids market size was valued at USD 1.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030.

Audiology Devices Market - The global audiology devices market size was valued at USD 8.9 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2022 to 2030.

Hearing Aids Market Segmentation

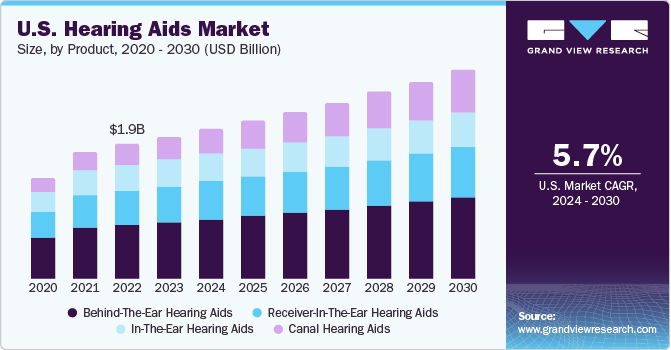

Grand View Research has segmented the global hearing aids market on the basis of product type, technology type, sales channel, type of hearing loss, patient type and region:

Hearing Aids Product Type Outlook (Volume, ’000 Units; Revenue, USD Million, 2017 - 2030)

- In-the-Ear Hearing Aids

- Receiver-in-the-Ear Hearing Aids

- Behind-the-Ear Hearing Aids

- Canal Hearing Aids

Hearing Aids Technology Type Outlook (Volume, ’000 Units; Revenue, USD Million, 2017 - 2030)

- Digital

- Analog

Hearing Aids By Type of Hearing Loss Outlook (Revenue, USD Million, 2017 - 2030)

- Sensorineural Hearing Loss

- Conductive Hearing Loss

Hearing Aids Patient Type Outlook (Revenue, USD Million, 2017 - 2030)

- Adults

- Pediatrics

Hearing Aids Sales Channel Outlook (Volume, ’000 Units; Revenue, USD Million, 2017 - 2030)

- Retail Sales

- Government Purchases

- E-commerce

Regional Outlook (Volume, ’000 Units; Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

March 2022: Sonova Holding AG completed the acquisition of Sennheiser electronic GmbH & Co. KG's Consumer Division. This will enhance Sonova's engaging product portfolio while also expanding its network footprint and client base.

February 2021: GN Store Nord A/S launched a new ReSound Key, a comprehensive hearing aid portfolio that provides more access to better hearing technologies throughout the world. This launch will enable the firm to expand its product offering and serve a larger consumer base.

Key Companies profiled:

Some of the prominent players in the Hearing Aids market include:

- Phonak

- Benson Hearing

- GN Store Nord A/S

- Starkey

- MED-EL

- William Demant Holding A/S

- Medtronic

- Widex USA, Inc.

- Sivantos Pte LTD

- Audina Hearing

Order a free sample PDF of the Hearing Aids Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment