Property Management Software Industry Overview

The global property management software market size was valued at USD 3.04 billion in 2021 and is expected to exhibit a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030. The market is expected to witness an incremental surge in demand for Property Management Software (PMS) owing to escalating demand for web-based services including Software as a Service (SaaS) by property management software providers. SaaS-enabled PMS helps manage daily operations including tenant and lease tracking, building maintenance, and accounting, among others. The software provides a centralized platform to view all the properties and also enables supervision of other property-related operations, such as maintenance tasks and addressing the requirements of tenants.

It mainly offers online document storage and sharing, electronic lease agreements, financial reporting, online maintenance requests and tracking, accounting capabilities, and integrated banking among other applications. In recent years, PMS solutions have shifted from manual to automatic management solutions. The automatic property management solution has improved the property management software system, thereby decreasing human errors and allowing property managers to allocate work assignments efficiently to avoid interruptions in service. An automatic PMS helps in reducing the time taken in responding to complaints and grievances of tenants or owners.

Gather more insights about the market drivers, restraints, and growth of the Global Property Management Software Market

Also, it simplifies the property management procedures by facilitating rent collection processes, tracking finances, reducing communication gaps, and storing and leasing documents and contracts, among others. Whereas, in traditional ways of property management the data is entered manually using Microsoft Excel, Notepad, or other spreadsheets, which makes the process slow, inefficient, and prone to errors. Also, landlords either manage their estate themselves or hire third-party property managers, which involves more workforce and time investment. Thus, property management software was formed to evade human errors and streamline the work through automation. The easy availability of PMS has automated and simplified the work of owners and estate managers.

Moreover, PMS solutions and computer record-keeping have significantly augmented the productivity of hospitality industries by updating and centralizing multiple computers and devices records. Also, PMS solutions can be customized as per the requirement of the hospitality industry to further upsurge ease of operations, including automation of bookings, hotel inventory supply management, check-in and check-out, Point of Sale (POS) integration, security and room locks, food and beverage costing, and reporting of Key Performance Indicators (KPI). Moreover, the advent of cloud technology is one of the key advances in the software industry. Cloud technology has significantly changed the way software applications are operated and provided to end-users.

This change has allowed software developers to focus on the technology feature of software while outsourcing the management feature to cloud service companies. SaaS software facilitates multifamily property management enterprises to easily integrate PMS software across the portfolio. SaaS platforms enable property managers to integrate advanced payment solutions with their property management software for easy and continuous transactions. In the wake of the COVID-19 outbreak, there has been a significant disturbance in most industries worldwide. While few industries experienced a contraction in their businesses and productions, others faced severe outcomes, such as the shutdown of businesses and movement restrictions, among others.

However, during the pandemic, the real estate industry experienced both a surge and decline all at once. In the initial phases of the pandemic (Q1 & Q2), real estate companies, managers, and property owners were majorly concerned with keeping visitors and tenants safe and adhering to governmental laws and regulations. As a result, decreased real estate property sales. Although several corporate offices, schools, and colleges are still closed, businesses are opting for the work-from-home option. On the contrary, the pandemic provided property managers an opportunity to introduce and use new automation tools, such as smart and AI-enabled property management software. The AI-enabled management tool collects the data through Wi-Fi and automatically responds to leads, helping in reducing operational risks and improving customer service.

Browse through Grand View Research's IT Services & Applications Industry Related Reports

PropTech Market - The global PropTech market size was valued at USD 25,145.1 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 15.8% from 2022 to 2030.

Business Process Management Market - The global business process management market was valued at USD 12.18 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.8% from 2022 to 2030.

Property Management Software Industry Segmentation

Grand View Research has segmented the global property management software market based on deployment, application, end-user, and region:

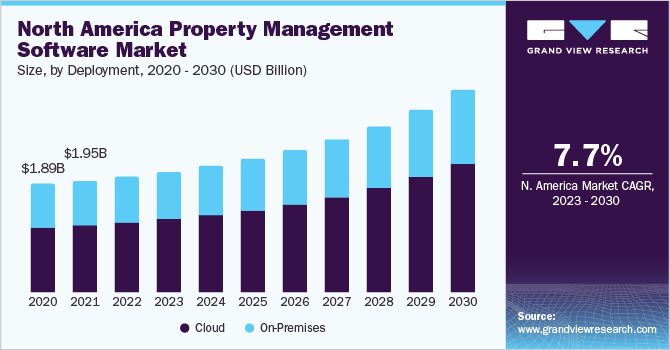

Property Management Software Deployment Outlook (Revenue, USD Million, 2017 - 2030)

- Cloud

- On-Premises

Property Management Software Application Outlook (Revenue, USD Million, 2017 - 2030)

- Residential

- Commercial

Property Management Software End-user Outlook (Revenue, USD Million, 2017 - 2030)

- Housing Associations

- Property Managers/Agents

- Property Investors

- Others

Property Management Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

April 2020: Yardi Systems Inc. announced new functionality updates for its existing Yardi Breeze property management software amid the COVID-19 pandemic. The new features include online state-based lease documents, credit/debit cards, ACH, or PayNearMe walk-in flexible payment options, and customer relationship management, among others.

Key Companies profiled:

Some prominent players in the global Property Management Software Industry include

- AppFolio, Inc.

- CORELOGIC

- Console Australia Pty Ltd

- Entrata, Inc.

- InnQuest Software

- IQware Inc.

- MRI Software LLC

- RealPage, Inc.

- REI Master

- Yardi Systems Inc.

Order a free sample PDF of the Property Management Software Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment