Antiseptics and Disinfectants Industry Overview

The global antiseptics and disinfectants market size was valued at USD 34.9 billion in 2021 and is expected to witness a compound annual growth rate (CAGR) of 10.1% from 2022 to 2030. An increase in the prevalence of diseases such as typhoid, cholera, hepatitis A, food poisoning, and dengue, primarily due to lack of home cleanliness, is one of the major factors expected to drive market growth. For instance, as per a report published by WHO in 2022, Over the last two decades, the number of dengue cases reported to WHO has surged by more than 8-fold, from 505,430 cases in 2000 to over 2.4 million in 2010, and 5.2 million in 2019. Such diseases are mainly caused by viruses, bacteria, and germs, which thrive in unhealthy home environments and unhygienic toilets, latrines, and kitchens.

The application of antiseptic and disinfectant solutions is, therefore, an essential requirement to maintain home cleanliness. Such solutions prevent the growth of harmful bacteria and viruses, reducing the chance of acquiring these diseases. Hence, an increase in awareness about home cleanliness is anticipated to propel the market for antiseptics and disinfectants over the forecast period. The current COVID-19 outbreak is expected to have a substantial impact on the market for antiseptics and disinfectants. The COVID-19 pandemic, as well as an overall increase in hospital admissions around the world, has boosted the demand for medical disposables.

Gather more insights about the market drivers, restraints, and growth of the Global Antiseptics And Disinfectants market

To meet the rising worldwide demand for cleaning, deodorizing, and disinfecting in high-traffic facilities, including office buildings, hotels, schools, nursing homes, and hospitals due to the COVID-19 outbreak, the WHO has urged industry and governments to expand the production of antiseptics and disinfectants. For instance, according to the German Federal Statistical Office, in 2020, demand for disinfectants has risen in the aftermath of the coronavirus pandemic, for example, 80% more hygiene products were produced in Germany between January and September 2020 than in the same period last year. Additionally, antiseptics and disinfectants manufacturing companies use unique and new technologies to design, produce, and sell products to diverse end customers based on the amount of protection required for distinct job risks.

For instance, in November 2020the Environmental Protection Agency (EPA) of the U.S. approved 3M's disinfectant TB Quat for SARS-CoV-2 which is a ready-to-use cleaner. Third-party lab testing of 3M's disinfectant TB Quat ready-to-use cleaner on hard, non-porous surfaces with a 60-second contact period proved the disinfectant's effectiveness against the virus. As a result, market growth is expected to accelerate in the near future. Moreover, in January 2021, 5 SC Johnson home cleaning products have been added to Health Canada's list of effective disinfectants for use against SARS-CoV-2. SC Johnson has approved the following disinfectants to kill SARS-CoV-2, the virus that causes COVID-19 symptoms like scrubbing bubbles. They come in a variety of fragrances. Thus, due to the past and ongoing advancements through various companies, the positive impact of the COVID-19 pandemic was seen on the market for antiseptics and disinfectants.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Medical Adhesive Tapes Market - The global medical adhesive tapes market size was valued at USD 750.9 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030.

Scar Treatment Market - The global scar treatment market was valued at USD 23.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030.

Antiseptics and Disinfectants Market Segmentation

Grand View Research has segmented the global antiseptics and disinfectants market on the basis of type, product, sales channel, end-use, and region:

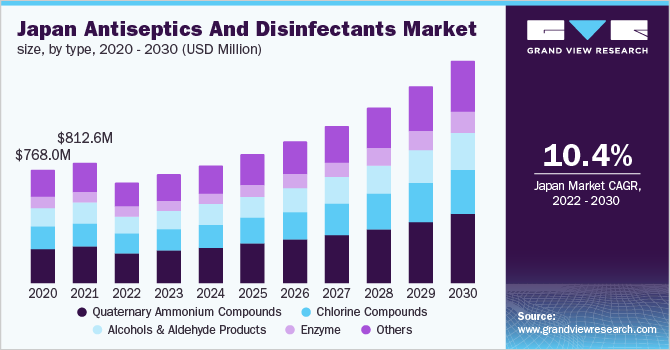

Antiseptics and Disinfectants Type Outlook (Revenue, USD Million, 2017 - 2030)

- Quaternary Ammonium Compounds

- Chlorine Compounds

- Alcohols & Aldehyde Products

- Enzyme

- Others

Antiseptics and Disinfectants Product Outlook (Revenue, USD Million, 2017 - 2030)

- Enzymatic Cleaners

- Medical Device Disinfectants

- Surface Disinfectants

Antiseptics and Disinfectants Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

- B2B

- FMCG

Antiseptics and Disinfectants End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals

- Clinics

- Others

Antiseptics and Disinfectants Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

January 2021: Cantel Medical Corporation was acquired by STERIS through a subsidiary in the U.S. Cantel is a global provider of infection prevention services and products, with a focus on dental and endoscopic customers.

June 2018: Fortive Corporation made a binding bid to buy Johnson & Johnson's Advanced Sterilization Products business, which is part of Ethicon, Inc.

Key Companies profiled:

Some prominent players in the global Antiseptics and Disinfectants market include -

- 3M

- Reckitt Benckiser

- Steris Plc

- Kimberly-Clark Corporation

- Bio-Cide International, Inc.

- Cardinal Health

- BD

- Johnson & Johnson

Order a free sample PDF of the Antiseptics And Disinfectants Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment