U.S. Hospital Facilities Industry Overview

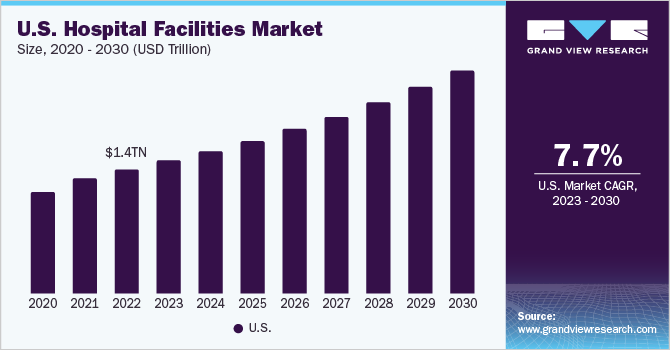

The U.S. hospital facilities market size was valued at USD 1,318.9 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 7.62% from 2022 to 2030. The growing impetus for better patient care and the entry of novel healthcare technology is expected to increase the demand for well-equipped hospitals in the coming years. According to the CDC, six out of ten adults in the U.S. have a chronic disease, such as cancer, stroke, heart disease, diabetes, and others, including four in ten adults having two or more chronic conditions. These and other non-communicable chronic illnesses are the foremost causes of disability and death in the U.S. They are also a leading driver of health care costs and are expected to drive the market during the forecast period.

The demand and supply gap in the U.S. healthcare system is growing rapidly. This is mainly due to the growing number of patients and limited resources available to provide the necessary care. Furthermore, the increase in the average life expectancy of the people has created a large geriatric population in the country, which requires special medical care, creating a strain on the medical system. The limited number of healthcare providers and facilities cannot fulfill the current requirement and thus the demand for healthcare facilities is growing continuously in the U.S. According to CMS, the U.S. government spent USD 4.1 trillion on national healthcare in 2020. The country spent 19.7% of its GDP on healthcare.

Gather more insights about the market drivers, restraints, and growth of the U.S. Hospital Facilities Market

As the number of patients keeps growing, the country’s healthcare expenditure is expected to grow rapidly, in turn, favoring the overall market growth. Over the years, there has been a significant rise in the number of surgical procedures performed in the U.S. According to an NCBI study, approximately 40 to 50 million surgical procedures are performed in the country every year. In addition, according to the National Center for Health Statistics, over 40 million inpatient surgical procedures were performed in the U.S., which is closely followed by 31.5 million outpatient surgeries. The procedures that were performed most frequently included the digestive system, musculoskeletal system, cardiovascular system, and ophthalmology.

This is expected to drive the demand for hospital services due to the availability of specialized medical staff and growing awareness about their effectiveness in healthcare settings. Furthermore, technological advancements, such as Artificial Intelligence (AI), electronic health records, mHealth, telemedicine/telehealth, sensors & wearable technology, wireless communication systems, remote-monitoring, robotics, and other notable innovations, are expected to drive the market during the forecast period. For instance, Northwestern Memorial Hospital and Caption Health announced a collaboration in October 2020 to bring new AI-powered ultrasound equipment into clinical practice.

The FDA-cleared, AI-guided ultrasound system enables healthcare practitioners to obtain and interpret high-quality ultrasound pictures of the human heart, therefore boosting access to accurate and rapid cardiac assessments at the point of care. The ongoing pressure on the hospital facilities is expected to reduce by mid-2021 as COVID-19 vaccination and treatments begin to emerge. Furthermore, privatization within the sector is expected to boost capital expenditure and promote revenue growth by the end of the forecast period. Furthermore, as these hospitals face dynamic regulatory changes, financial pressure, and reduced profits, the market is expected to witness rapid consolidation, which will enable them to pool resources and increase their capital expenditure.

Browse through Grand View Research's Medical Devices Industry Related Reports

U.S. Child Care Market - The U.S. child care market size was valued at USD 33.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.15 % from 2022 to 2030.

U.S. Group 2 Powered Mobility Devices Market - The U.S. group 2 powered mobility devices market size was valued at USD 2.6 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 12.0% from 2023 to 2030.

U.S. Hospital Facilities Market Segmentation

Grand View Research has segmented the U.S. hospital facilities market on the basis of patient service, facility type, service type, bed size, and region:

U.S. Hospital Facilities Patient Service Outlook (Revenue, USD Billion, 2017 - 2030)

- Inpatient Services

- Outpatient Services

U.S. Hospital Facilities Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Private Hospitals

- State-owned & Federal Hospitals

- Public/Community Hospitals

U.S. Hospital Facilities Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Acute Care

- Cardiovascular

- Cancer Care

- Neurorehabilitation & Psychiatry Services

- Pathology Lab, Diagnostics, and Imaging

- Obstetrics & Gynecology

- Others

U.S. Hospital Facilities Bed Size Outlook (Revenue, USD Billion, 2017 - 2030)

- 0-99

- 100-199

- 200-299

- 300-more

U.S. Hospital Facilities Region Outlook (Revenue, USD Billion, 2017 - 2030)

- Northeast

- Southeast

- Southwest

- Midwest

- West

Market Share Insights:

May 2021: UCSF Health announced a collaboration with Royal Philips to develop technology that will enable a more modern, streamlined patient experience and establish a new standard for healthcare delivery.

February 2021: Northwestern Medicine Kishwaukee Hospital partnered with Lurie Children’s for the Pediatric Emergency Medicine telemedicine program.

Key Companies profiled:

Some prominent players in the U.S. Hospital Facilities market include

- The Johns Hopkins Hospital

- Mayo Clinic

- Cleveland Clinic

- Cedars Sinai

- Massachusetts General Hospital

- UCSF Health

- NewYork-Presbyterian Hospital

- Brigham And Women's Hospital

- Ronald Regan UCLA Medical Center

- Northwestern Memorial Hospital

Order a free sample PDF of the U.S. Hospital Facilities Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment